AUM of Silver ETFs Crosses 13,500 Crs within 3 years: Zerodha Fund House

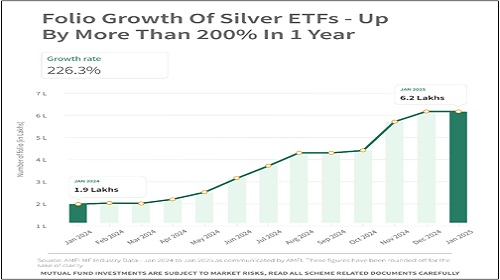

In November 2021, SEBI (Securities and Exchange Board of India) allowed Asset Management companies to launch silver ETFs (Exchange-Traded Funds). Since then, silver ETFs have seen massive growth (as shown in below graph) in AUM, crossing the 13,500 cr mark as of Jan 2025. There are 12 Silver ETFs with more than 6 Lakh investor folios across them as of Jan 2025.

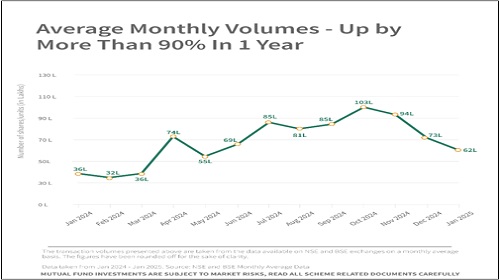

Talking about the historical transaction volumes of Silver ETFs, Vaibhav Jalan, CBO of Zerodha Fund House said, “The increasing transaction volumes of silver ETFs are a clear indication of growing investor interest. These ETFs offer an alternative to physical silver ownership, addressing concerns about storage, security, and insurance while providing access to silver's price movements.”

Silver Demand has Far Surpassed the Supply

Since 2021, the demand for silver has outpaced its supply. This versatile metal is both a valuable commodity and a crucial component in various industries, including solar energy and automotive manufacturing. Silver's diverse applications, from industrial uses to jewellery, digital photography and investment also contribute to its demand.

Industrial Demand for Silver has Increased by More than 55%

According to the estimates by ‘The Silver Institute’, the overall industrial demand for Silver has increased by more than 55% driven by its applications across various industries, including automotive, technology, pharmaceuticals, and solar energy. Silver is also used in manufacturing and industrial fabrication since it does not corrode and has good thermal properties.

Vishal Jain, CEO of Zerodha Fund House says, “Silver has the potential to play a role in both investment portfolios and modern industries. Silver ETFs are a valuable tool to diversify one’s portfolios and capitalize on the metal's unique characteristics.”

In a three-year period, from (Jan 2022- Jan 2025), the AUM of Silver ETFs have crossed Rs13,500 Crs! Also, as of Jan 2025, with over 6 lakh investor folios, it's clear that Indian investors are taking exposure to silver. As investors seek diversification and exposure to commodities, Silver ETFs provide a simple and hassle free way to take exposure to this precious metal.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...