Annual Equity Outlook 2026 by ICICI Prudential Mutual Fund

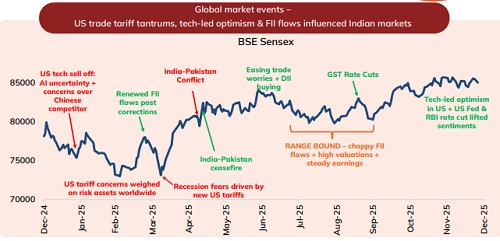

Recap 2025 – The See-Saw of Equity Markets

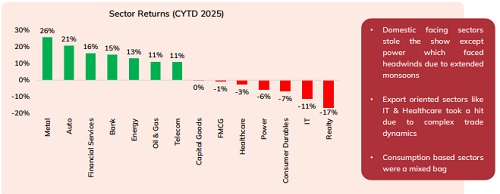

Sector Spotlight – Domestic facing sectors take Centre Stage

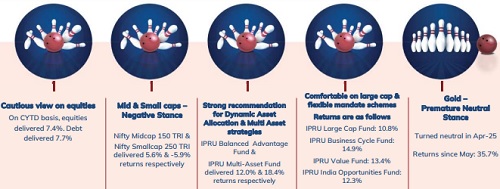

What did we say in 2025? Hits & Misses

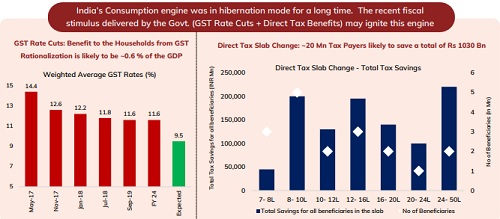

STEPPING OUT OF HIBERNATION

Markets are normally characterized by two states – Bullish & Bearish. Rarely is the in-between phase i.e. the ‘hibernation phase’ spoken about. Just as some animals enter the hibernation phase to survive harsh winters by slowing their body functions, markets too hibernate during economic uncertainties

‘HIBERNATION’ – This has exactly been the state of Indian markets in last few years, where due to global economic & geo-political uncertainties there was no clear direction. Exogenous factors have been persistently impacting Indian markets; global central banks policy stance, geo-political tensions, FII outflows and the recent one being reciprocal trade tariffs on countries by the US. These factors not only contributed to volatility but also failed to paint a clear picture about market direction in recent years. Hence markets were in ‘hibernation mode’

Normally, animals who hibernate gather soft materials like leaves, grass, fur to insulate themselves from cold and accumulate food for emergencies. That marks their survival strategy. In a similar fashion, when market direction is uncertain, it is difficult for one asset class to deliver returns and hence a prudent mix of equity, debt, gold, etc. is required to survive uncertainties. Hence, asset allocation strategy has been our top recommendations in the last few years

Animals when they step out of hibernation, tend to keep an eye on surroundings. Similarly, this is a year where we believe that markets are stepping out of hibernation and the sun is shining. However, there are some key triggers that investors need to watch out for that may have an impact on markets.

Delve into next few slides to get detailed insights on markets, our outlook & key recommendations for 2026

Stepping out of Hibernation – Policy Push for Consumption Pull

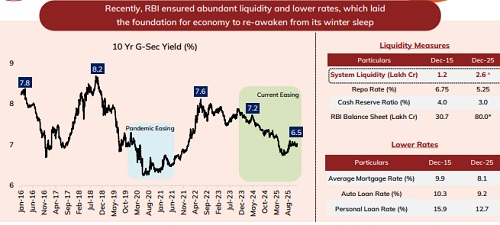

Stepping out of Hibernation – RBI pours Liquidity

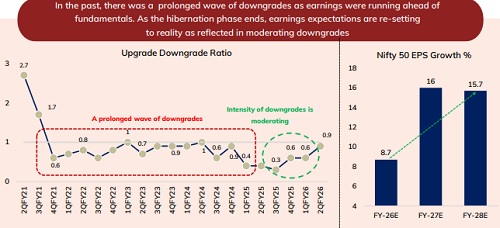

Stepping out of Hibernation – Earnings’ Wake Up Call

Above views are of the author and not of the website kindly read disclaimer