AMI Organics Limited reports Q3 and 9MFY24 Results

Ami Organics Limited (AMI) (BSE: 543349, NSE: AMIORG), a leading global manufacturer of advance pharmaceutical intermediates and speciality chemicals, today announced financial results for the third quarter and nine months ended December 31, 2023.

Consolidated Financial Results – Q3 & 9MFY24:

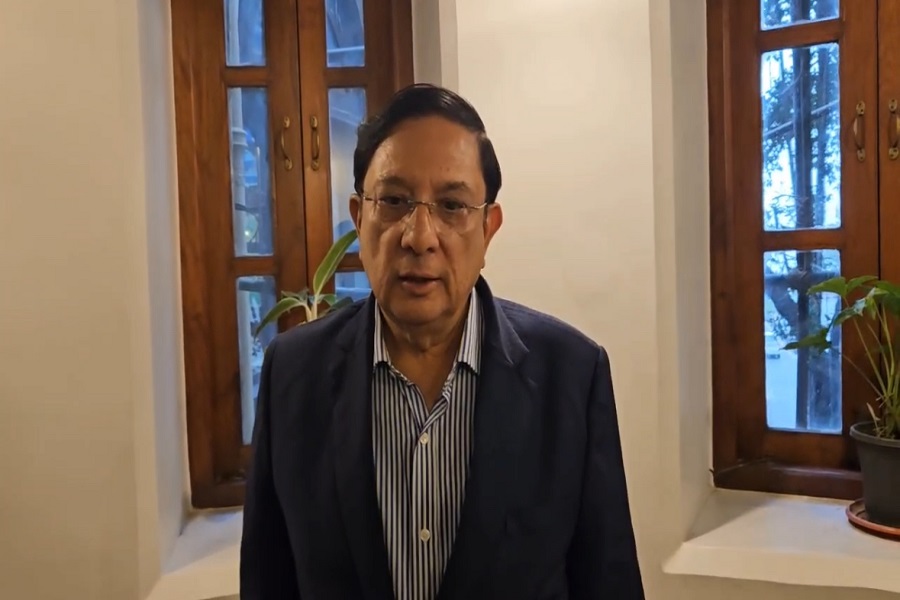

Commenting on results, Mr. Naresh Patel, Executive Chairman & Managing Director, Ami Organics Limited, said, “In the face of a challenging landscape of the chemical industry, I am pleased to report that we have been able to deliver quality growth in Q3FY23 with our revenue from operations growing 9.2% YoY to Rs. 1,664mn. This growth is underpinned by robust volume growth of 25%, indicating strong business traction.

During the quarter, we further solidified our relationship with Fermion by signing an agreement for two additional advanced intermediates for their APIs. This milestone reflects AMI Organics’ prowess in fostering enduring client relationships, ably supported by strong R&D and manufacturing strengths. Additionally, we also inaugurated a state-of-the-art, technology-driven plant at our Ankleshwar site, designed to meet the growing demand in the Pharmaceutical intermediate business.

I am also excited to share that we have signed an MOU with a global manufacturer of Electrolytes for the manufacturing of electrolytes for battery cells and allied materials. In this context, we have also signed a MoU with the Government of Gujarat for investment amounting up to Rs 300 crores for setting up of a dedicated manufacturing facility for electrolytes business in Gujarat.

Despite the industry headwinds, we remain confident of closing the year with healthy growth. I would also like to highlight that the various initiatives we have taken in FY23 and FY24 enhances our revenue visibility for FY25 and beyond, bolstering our confidence in our potential for stronger growth in coming years.”

Key Results Highlights (Q2 FY24 Consolidated):

* Revenue from operations for Q3FY24 grew by 9.2% YoY to Rs. 1,664 mn

* The gross margin for the quarter was at 42.9% as compared to 46% in Q3FY23 and 41% in Q2FY24. Gross margins contracted 303 basis points YoY but expanded by 190 bps sequentially. Gross margins were driven by unfavourable product mix and pricing pressure.

* EBITDA for the quarter came at Rs. 265 mn down 13.9% YoY compared to Rs. 308 mn in Q3FY23 and up 6.8%, QoQ compared to Rs. 248 mn in Q2FY24.

* EBITDA margin for the quarter was at 15.9% as compared to 20.2% in Q3FY23 and 14.4% in Q2FY24. EBITDA margins de-grew by 430bps YoY and grew by 153 bps sequentially. EBITDA margins were largely driven by gross margins.

* PAT for the quarter was Rs. 178 mn. The PAT margin for the quarter was 10.7%.

Key Business highlights:

* Export at 61%; domestic business at 39%

* Advance Pharmaceutical Intermediates

* Signed a new agreement with Fermion for two additional advanced intermediates

taking total products under CDMO with Fermion to 5

* Inaugurated a state-of-the-art technology driven plant in Ankleshwar in December 2023 which will focus on advanced pharmaceutical intermediate business

* Electrolyte Business:

* Signed a MOU with a global manufacturer of Electrolytes for manufacturing of electrolytes for battery cells and allied materials

* Signed MOU with the Government of Gujarat for investment amounting up to Rs 300 crores for set up of dedicated manufacturing facility for electrolytes business in the state of Gujarat

* Successfully passed the ISMS 27001-2022 audit. Received ISO 27001:2022 standard certification.

* Certified as Three Star Export House by Government of India

Above views are of the author and not of the website kindly read disclaimer

.jpg)