Aluminium prices marked a monthly gain due to supply concerns after a fuel - Geojit Financial Services Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Aluminium prices in global futures platforms rose to monthly highs due to supply worries after a blast occurred in a bauxite terminal in Guinea. Additionally, a weaker U.S. Dollar also improved sentiments in the base metal.

Global Economy

• Most global equity gauges were on positive territory in the volume thinned trades last week.

• U.S. economy expanded an annualized 4.9% in the third quarter of 2023, slightly below 5.2% shown in the second estimate.

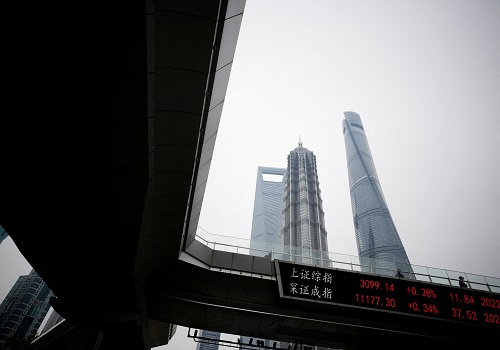

• China’s manufacturing Purchasing Managers’ Index stood at 49 in December. It was the third straight month of contraction in factory activity and the steepest pace in 6 months

• In December, People’s Bank of China left its benchmark lending rates unchanged. Its one-year loan prime rate (LPR) was kept at 3.45%, while the five-year LPR was unchanged at 4.20%.

Currencies

• The U.S. dollar index, a measure of greenback, fell 0.36 percent last week and settled at 101.33.

• Euro gained 0.24% against USD last week. Japanese Yen gained 0.96% while China’s Yuan gained 0.47%.

• Indian Rupee moderated against U.S. dollar in the last week’s session and settled at 83.19 points.

Aluminium

• Aluminium futures marked monthly gains in global platforms. In LME, aluminium surged 7.92% last week. Meanwhile in MCX and SHFE, the prices surged more than 5.0%.

• Russia, the second largest aluminium producer, raised primary aluminium output 3.5% year-on-year in January-November 2023.

• The U.S. suspended import tariffs on Aluminium and Steel from European Union through December 31, 2025.

Aluminium prices marked monthly gain

Aluminium prices marked a monthly gain due to supply concerns after a fuel depot blast in major raw material producer Guinea and a weaker dollar. The blast at an oil terminal in major bauxite supplier Guinea sparked fears of a shortage of the feed material for alumina, an intermediary product for aluminium. Meanwhile, a weaker U.S. dollar also buoyed prices as it makes dollar-denominated metals more attractive for buyers using other currencies. Slowing of U.S. inflation further in November cemented market expectations for a U.S. interest rate cut next March, dragging the U.S. dollar lower against its key currency counter parts. Meanwhile, concerns grew as some of the metal’s shipping routes were at risk as maritime carriers avoided the Red Sea due to vessel attacks, causing disruptions in traffic through the Suez Canal, which handles about 12% of global trade.

In London Metal Exchange platform, the three month forward aluminium futures gained 7.92% in the last one month period. Meanwhile, most active aluminium futures in SHFE and MCX gained more than 5.0%.

Russia raised aluminium output 3.5% in 11 months

Russia, the second largest aluminium producer, raised primary aluminium output 3.5% year-on-year in January-November 2023, the State Statistics Service (Rosstat) showed. The output rose 1.8% year-on-year in November and was 1% lower than in October 2023.

U.S. extends EU steel, aluminium tariff exemption for 2 years

U.S. President Joe Biden extended the suspension of tariffs on European Union steel and aluminium for two years to continue negotiations on measures to address overcapacity and low-carbon production. U.S. suspended import tariffs of 25% on EU steel and 10% on EU aluminium for two years from January 2022, replacing the tariffs imposed by former President Donald Trump with a tariff rate quota (TRQ) system. The TRQ allows up to 3.3 million metric tons of EU steel and 384,000 tons of aluminium into the U.S. tariff-free, reflecting past trade levels, with the tariffs applying for any further amounts. The new exemption applies through December 31, 2025.

Warehouse stock level

Aluminium inventories in LME registered warehouses jumped to fresh highs this week after more inflows highlighting excess supply. In the last week, the aluminium inventory levels in LME registered warehouses increased last week by 25325 MT and totalled 549050 MT. At the same time, the inventory level in SHFE registered warehouses decreased to 3083 and totalled 99029 MT

Outlook Shanghai Futures Exchange : Sturdy gains above CNY 19700 may offer further upside. However, an drop below CNY19300 would be an early signal for weakness.

MCX Jan: Prices may appear firmer above 228 region. Inability to cross above the same region will hold the prices in a narrow range. Weakness may be expected below 193 region.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">