Add Tata Motors Ltd For Target Rs. 892 By Yes Securities Ltd

Macro challenges yet not over both at JLR&S/A

View – Sharp stock correction yet to make risk reward favorable!

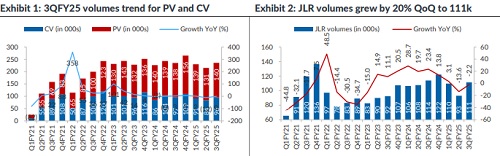

TTMT’s 3QFY25 consol results were operationally mixed led by higher-thanexpected VME at JLR at 4.2% in 3QFY25 (vs 1.7% YoY, 3.2% in 1QFY25 and ~4% in 2QFY25), dragged its EBITDA margins at 14.2% (-200bp YoY, est 15%). This was partially offset by better S/A margins (incl. PLI) at 13.4% (est 13%). On the positive side, deleveraging is on track with net auto debt declined to ~Rs Rs193b in 9MFY25 (vs Rs220b in 1HFY25, Rs160b in FY24 and Rs437b in FY23). While management sounded confident of further volume recovery in 4Q (seasonally strong quarter) and have maintained JLR EBIT guidance of 8.5% (vs ~7.7% in 9M), implying +10% EBITM in 4QFY25. This we believe is challenging as its largely hinges on volumes given key margins drivers such as 1) peak LR contribution, 2) RM tailwinds and 3) controlled VME is now moderating QoQ given demand challenges cropping up in key markets like Europe, UK and China while the US is still strong.

We have liked TTMT given it’s improving India franchise, early leadership in EVs in India, and JLR’s improved profitability. However, standalone business is in the midst of cyclical volume moderation both in PV and CV whereas heightened competition in EVs can drag earnings momentum in S/A. We increase FY26/27 consol EPS by 4-5% to reflect upon PLI incentives while likely muted volumes at JLR, increased VME partially impact consolidated earnings. We maintained ADD with revised Mar’27 SOTP based TP of Rs892 (v/s Rs948 earlier). Despite sharp correction recently, we would still wait for better entry point. We like MM, HYUNDAI, TVS and EIM in OEMs

Result Highlights – Mixed bag; S/A better, JLR in-line while CJLR weak

* Consol revenues grew 2.7% YoY (+12% QoQ) at Rs1135.7b (est Rs1228.4b) as S/A revenues de-grew 8.7% YoY at Rs170.4b (est Rs176.8b) and JLR revenues grew 1.5% YoY at GBP7.48b (est GBP8.1b).

* Consol EBITDA de-grew 15% YoY (+11.7% QoQ) at Rs130.3b (est Rs159.2) with margins contracted 240bp YoY (flat QoQ) at 11.5% (est 13%). JLR EBITDA margins came in lower at 14.2% (est 15%, -200bp YoY). Lower depreciation at GBP377m (v/s GBBP434m QoQ).

* Segmental EBIT performance - 1) JLR at ~9% (+20bp YoY/+390bp QoQ, est 8.5%) 2) Domestic CV at 9.6% (+100bp YoY), 3) Domestic PV at 1.7% (-40bp YoY)

* CJLR performance - Revenues degrew ~18.4% QoQ at GBP253m as volume degrew 31%, EBITDA margins at ~24% (vs ~16% QoQ) while higher depreciation led to PAT loss at GBP19m (vs +GBP5m QoQ).

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632