Adani Green Energy zooms on securing $1.36 billion construction facility

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Adani Green Energy is currently trading at Rs. 1322.75, up by 199.40 points or 17.75% from its previous closing of Rs. 1123.35 on the BSE.

The scrip opened at Rs. 1125.00 and has touched a high and low of Rs. 1341.60 and Rs. 1098.00 respectively. So far 709613 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 10 has touched a 52 week high of Rs. 2185.30 on 18-Jan-2023 and a 52 week low of Rs. 439.35 on 28-Feb-2023.

Last one week high and low of the scrip stood at Rs. 1341.60 and Rs. 1007.00 respectively. The current market cap of the company is Rs. 211309.93 crore.

The promoters holding in the company stood at 56.26%, while Institutions and Non-Institutions held 19.65% and 24.08% respectively.

Adani Green Energy (AGEL) has sealed its largest project financing of $1.36 billion senior debt facility as part of its Construction Financing Framework to enhance the funding pool to $3 billion since initial project financing in March 2021. The financing will be a key enabler for developing the world’s largest renewable energy park at Khavda in Gujarat.

The groundbreaking transaction is a testament of India’s commitment to accelerate climate action and comes at an opportune time when global economies converge at 28th United Nations Climate Change Conference (COP28) to pledge their approaches towards energy transition and emissions-reduction goals. The facility is Green Loan certified by the Second Party Opinion Provider Sustainalytics. 8 International banks have participated in this marquee transaction.

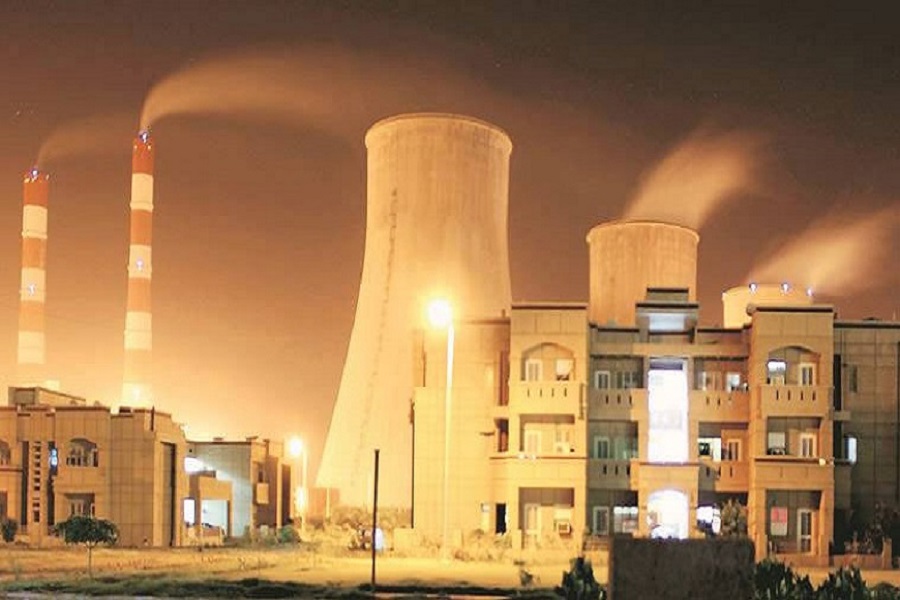

Adani Green Energy builds, owns and operates power plants powered by renewable sources of energy like solar and wind.