A bullish crossover in the daily RSI above the 50 mark further supports the strength of the ongoing trend - Tradebulls Securities Pvt Ltd

Nifty

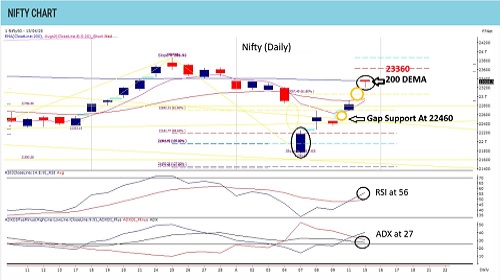

The occurrence of a narrow-range candle near the 200 DEMA zone around 23360, following a series of gap-up moves, raises questions about the sustainability of current momentum. Over the past four trading sessions, the index has recovered nearly 70% of the recent decline, rallying over 1600 points from the swing low of 21743. Currently, the index is trading significantly above its short-term moving averages, with 22950 emerging as a key immediate support zone. Options data indicates 23300 and 23000 as strong base zone for the rest of the series, while the upside remains open toward the 23800–24000 region. A bullish crossover in the daily RSI above the 50 mark further supports the strength of the ongoing trend. After such a sharp up move, a phase of consolidation would be healthy and could provide a stronger platform for sustained gains. Momentum traders are advised to hold long positions as long as the index sustains above 22250 on a closing basis. Instead of chasing breakouts, prefer pullbacks for fresh entries. While investors should remain constructive on the broader market given the positive structure and continued sectoral leadership in financials.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

More News

Stock Insights : Adani Enterprises Ltd, Adani Power Ltd, Apollo Hospitals lTD, Ceigall India...