Zinc Article : Prices are expected to trade lower till Rs 240/kg in the coming four months. Says Mr. Saish Sandeep Sawant Dessai, Angel One Ltd

Zinc Article 25 July 2022 By Mr. Saish Sandeep Sawant Dessai, Research Associate- Base Metals, Angel One Ltd

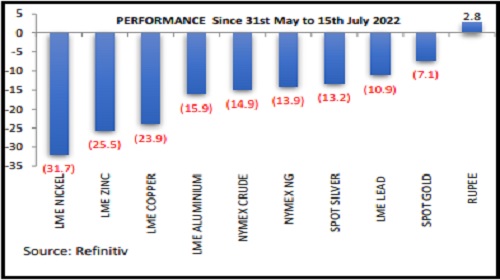

Price performance

The global economy is slowing down for sure as the price fall in all the commodities seen in the chart alongside tells us the story.

Within commodities, metals as a sector have taken a drastic hit with a fall of two digits in LME Nickel (-31.7%), LME Zinc (-26%), LME Copper (-23%), and Aluminium (-16%).

On the other hand, MCX Copper and Zinc prices have fallen by 21% and 20% respectively, followed by Aluminium prices with a fall of 16%.

Global economy in a roll

The fall in the metals and other commodities in the recent weeks was on account of actions by the central bank in the US. US inflation is at 40-year highs with a print of 9.1% as of June 2022 because of the rising energy component in the overall inflation basket. To tackle this situation, the central bank is on the verge of raising interest rates for the whole of 2022. It began by raising rates by 25 basis points in its meeting in March 2022, then by 50 and 75 basis points, respectively. This led to the strengthening of the dollar index and in turn the fall in the metals and other commodities.

In the Euro Area, inflation is at all-time highs with a number print of 8.6% as of June 2022 and ECB is hawkish with a hike in the interest rates in its upcoming meeting. The European central bank went with a surprise rate of 50 basis points, the first hike in 11 years.

The hike comes in the wake of the rising inflation, which has led to a slowdown in the economic activities of different European countries. And it is seen spreading to other parts of the world as aggressive tightening of the US Federal Reserve, structural changes in China's economy, and the impact of its COVID-19 lockdowns have dragged down industrial metals in the range of 20 to 30% in Q2 2022 (April to June), which was arguably the sharpest quarterly decline since the Global Financial Crisis in 2008.

If we look at the manufacturing activities of these economies, the downturn is clearly noticeable. The PMI statistics for the US and Euro Area are still over the threshold of 50, but they have been trending lower since the beginning of the year, so it won't be shocking if they drop below that level. A value of less than 50 implies that the economy is contracting.

Two of the Fed's more aggressive policymakers announced their support for a 75-basis point rate increase at the upcoming meeting. However, the market anticipates that the Fed may decide to raise rates by 100 basis points unexpectedly as a result of the highest inflation rates seen since 1980.

Amid these interest rate increases and inflation, a risk is emerging that some major economies may experience a hard landing.

Zinc Smelter disruptions, short squeeze & help from Asia

According to the most recent report from the International Lead and Zinc Study Group, global mine production increased by 1% in the first four months of this year compared to the same period last year, but refined production decreased by 2%.

SMELTER DISRUPTION

The demand for raw materials by zinc smelters is uncertain due to pressure from increasing operating expenses. The largest European zinc smelters have been compelled to reduce production since the last quarter of 2021 due to historically high electricity prices that have been made worse by the conflict in Ukraine.

Europe accounts for around 15% of global zinc refining capacity, meaning it is now acting as a major drag on global runrates. The energy shortage has already resulted in Glencore's 100,000-ton-per year Portovesme smelter in Italy having to tone down production.

One of three refined metal producers in Canada, the Flin Flon smelter, will be completely retired this quarter as the feeder mine shuts down after 18 years of operation. The facility has been gradually closing down, as production dropped from 112,000 tonnes in 2020 to 90,000 tonnes. The loss of supply has been compounded by lower output at a second Canadian smelter. South American smelter supply has also been misfiring, as Nexa Resources reported first-quarter output of 48,700 tonnes at its two Brazilian smelters, down from 58,700 in the previous quarter, due to a lack of feed.

Zinc squeeze on the cards?

The zinc stocks at the London Metal Exchange (LME) have been raided, and the inventory close to depletion. It's an unhappy scenario for the exchange, as in March, when a similar run-on stock led to a price melt-up, the nickel contract had to be suspended. This time, though, there is a safety net. Deferred delivery is permitted, and lending restrictions have been set by the LME.

Moreover, this zinc squeeze is firmly rooted in the physical supply chain. They're about to drop significantly because cancellations are occurring prior of the actual load-out. In a 14 million tonne market, the amount of live tonnage available is probably equal to a few hours’ worth of global consumption. In LME zinc stocks, a long-term slump is now accelerating. The physical supply chain is the tightest, as seen by the lower availability of zinc in Europe and the limited zinc supply in some US regions.

China the supplier of last resort

The good news for struggling zinc buyers is that assistance from China is approaching. Since enacting a 15% levy on exports in 2008, the nation has been a consistent importer of refined zinc. While stocks may take some time to leave Asia, the ongoing power crisis in Europe has exposed structural issues with the region's energy mix that will only worsen as the bloc pushes toward decarbonization.

March's outbound shipments of 35,546 tonnes were the highest monthly tally since 2007. Cumulative exports of 53,500 tonnes over January-May have already exceeded combined volumes over 2020 and 2021. . The less pleasant news for the rest of the world is that this metal is only making it as far as Taiwan, where 25,750 tonnes of shipments from last month ended up, and Singapore, where 7,400 tonnes went. Both are LME good-delivery sites, and it is apparent that since the beginning of May, the Taiwanese port of Kaohsiung has received over 30,000 tonnes of zinc, representing the sole recent inflows into the exchange's global warehouse system.

Zinc Inventories at the lowest

Inventory levels at the LME registered warehouses have fallen to a historic low in 2022 after declining by over 36% from the year's beginning. Geopolitical tensions between the two largest countries in Europe (Russia and Ukraine) have resulted in harsh sanctions on Russia that are having an impact on the entire oil and gas supply chain, particularly base metals. These factors are raising gas and fuel costs and resulting in underutilization of industry capacity throughout Europe. Base metals supply shortage is urging traders to procure zinc from Asia.

China is on the diverging path

The deteriorating economic conditions in China were a significant contributor to the decline in metal prices. Metals prices remain highly sensitive to developments in China, the world’s largest metal consumer, as it consumes more than 50% of the world's industrial metals supply, the country witnessed an outbreak of Covid-19, post which the government announced lockdowns in major cities that crippled the entire economy and reduced demand for metals.

The nation's manufacturing sector suffered as a result of the lengthy lockdowns. Charts show that the PMI for majority of 2022 has been below the 50-mark, which acts as a threshold level. A score of less than 50 indicates that the country's economy is contracting, while a value more than 50 indicates that the economy is expanding. However, the figures have improved since reaching their lowest point in April.

And looking at the latest reading, the PMI value of 52.7 has exceeded the levels of December 2021, indicating that the country’s economic activity is coming back on track after the government officials lifted the covid restrictions.

Other areas have also shown signs of improvement. For example, China's trade balance has increased after falling earlier in the year, as exports rose and imports remained subdued. Since then, the surplus figures have increased for four months in a row. The trade surplus reached record highs in the most recent reading, increasing to 98 billion USD, exceeding the previous high of 83 billion USD seen at the beginning of the year

However, production of 10 nonferrous metals, including copper, aluminium, lead, zinc, and nickel, increased by 3.2 percent to 5.7 million tonnes in June from a year earlier. The first half of the year's output increased 1% to 32.83 million tonnes as the government started to relax the restrictions it had imposed following the Covid-19 outbreak in the nation.

Outlook

Given the optimistic views coming from China, the world's largest metal consumer, whose economic activities are picking up after the government eased the Covid-19 limitations. Additionally, given that the PMI curve is heading upward, an increase in demand is anticipated.

The US dollar, which is now hovering close to its highs, would hurt demand because these metals become more expensive when the dollar strengthens, which would restrict the upside in the metals. Other reasons that might keep prices under pressure include recession fears in the US and Europe, rising inflation and the central bank's stance.

We advise a sell on rise strategy in Zinc till Rs 295/kg (CMP: 271.20), and expect the prices to trade lower till Rs 240/kg in the coming four months.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

.jpg)

More News

Australia`s Grain Output Dips on Dry Weather Conditions by Amit Gupta Kedia Advisory