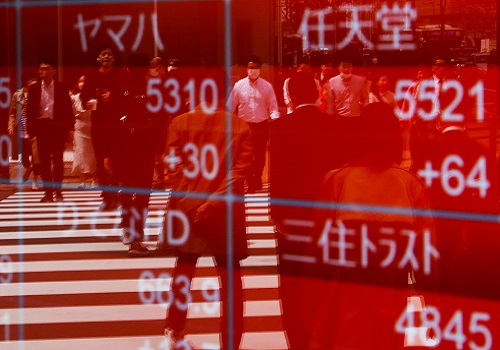

Yen soars to 4-month peak after surprise BOJ policy tweak

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The yen surged to a four-month peak against the dollar on Tuesday after the Bank of Japan said it would review its yield curve control policy and widened the trading band for the 10-year government bond yield in an unexpected tweak.

While it kept broad policy settings unchanged - pinning short-term JGB yields at -0.1% and the 10-year yield around zero - it widened the allowable band for long-term yields to 50 basis points either side of that, from 25 basis points previously.

The dollar tumbled as much as 3.1% to 132.68 yen, a level last seen in mid-August.

Eyes will now be trained on BOJ Governor Haruhiko Kuroda's media briefing later in the day for additional hints about a pivot away from ultra-easy policy. Most BOJ watchers had expected no changes until his 10-year term finishes at the end of March.

"This was really out of the box," said Bart Wakabayashi, branch manager at State Street in Tokyo.

"We're seeing them start to test the market about the exit strategy," he added. "It will depend on Kuroda's comments later today, but we could see a break below 130. It's very much within reach this year."

The 10-year JGB yield jumped to 0.46% from the previous cap at 0.25%. It pulled equivalent U.S. Treasury yields higher as well, with the 10-year soaring to the highest this month at 3.711%.

The U.S. dollar index sank, dropping 0.21% to 104.42 and returning to the middle of its trading range this month of 103.44 to 105.90. The index measures the greenback against the yen and five other major peers, including the euro and sterling.

It had been moving towards the top of that range before the BOJ announcement as investors continued to digest the Federal Reserve's message of higher interest rates for longer.

The yen's gains were broad, with the euro tumbling about 3% to the lowest since Dec. 2 at 140.90 yen and sterling also sliding some 3% to the lowest since Oct. 12 at 160.87 yen.

Against the dollar, the euro declined 0.26% to$1.0579 and sterling eased 0.33% to $1.2105.

The Aussie and New Zealand dollars each fell about 3.5% to 88.37 yen, a seven-month trough, and 84.11 yen, a 5-1/2-week low, respectively.

"You can look across any yen pair and they look very similar – strength to the yen to the detriment to the currency you trade it against," Matt Simpson, market analyst at City Index, wrote in an email.

"From here is looks as though USD/JPY could be headed for 130 now that it has broken to a new cycle low."

Against the greenback, New Zealand's dollar dropped as much as 1% to $0.6301, a two-week low, extending earlier declines following a big drop in a survey of local business confidence.

The Australia dollar slumped as much as 1% to $0.6629 for the first time since Nov. 22.