World shares off record peak, dollar edges higher

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

By Matt Scuffham and Carolyn Cohn

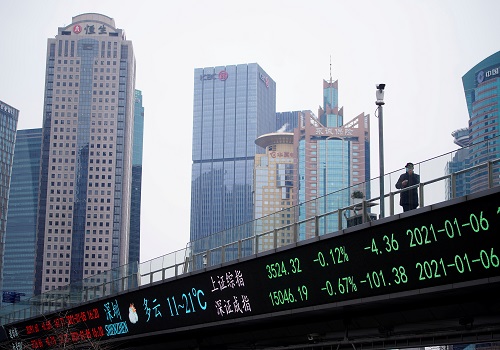

NEW YORK/LONDON (Reuters) - World shares softened following Thursday's record peak on strong U.S. data and earnings, while the dollar was on course to narrowly avoid a fourth straight weekly decline.

MSCI's broadest gauge of world shares dipped but remained close to a record peak touched the previous day, and on track for its strongest month since November.

The index, which covers 50 markets, shed 0.49%.

The Dow Jones Industrial Average fell 123.28 points, or 0.36%, to 33,937.08, the S&P 500 lost 18.14 points, or 0.43%, to 4,193.33 and the Nasdaq Composite dropped 60.54 points, or 0.43%, to 14,022.01.

Data on Thursday showed U.S. economic growth accelerated in the first quarter, fuelled by massive government aid to households and businesses.

That came against the backdrop of the Federal Reserve's reassurance on Wednesday that it was not time yet to begin discussing any change in its easy monetary policy.

With just over a half of S&P 500 companies reporting earnings, about 87% beat market expectations, according to Refinitiv, the highest level in recent years.

"The Federal Reserve continues to support, Biden has this huge stimulus programme as well and the earnings season continues -- so far we have seen relatively benign as well as strong earnings," said Eddie Cheng, head of international multi-asset portfolio management at Wells Fargo Asset Management.

For both the MSCI world index and the S&P500, analysts are expecting earnings in the next 12 months to recover to above pre-pandemic levels.

In Europe, the pan-European STOXX 600 index rose 0.13%

Euro zone GDP data showed a year-on-year drop of 1.8% in the first quarter, stronger than expectations of a 2% fall, though economists said the bloc was on a recovery path.

"There is increasingly bright light at the end of the tunnel," Commerzbank analysts said.

"The speed of the vaccinations is picking up and the EU recovery fund is also finally getting off the ground."

New coronavirus infections in India surged to a fresh record, however, and France's health minister said the dangers of the Indian variant must not be underestimated.

"Risky assets have had quite a few wobbles within the month," said Cheng.

"We need to get used to the fact that this is not going to be a straight line."

The euro extended its bull run to a two-month high of $1.2150 in the previous session before dropping 0.30% following the euro zone data.

"The euro is more sensitive to the European economic outlook, than to (what) happens in the U.S.", said Kit Juckes, head of FX strategy at Societe Generale.

The dollar index, a measure of the greenback's value against a basket of major peers, rose 0.299%, leaving it set to end the week flat, although still down 2.56% for the month as a whole.

Oil prices fell on concerns about wider lockdowns in India and Brazil.

U.S. crude recently fell 1.85% to $63.81 per barrel and Brent was at $67.40, down 1.69% on the day.

Spot gold dropped 0.1% to $1,770.15 an ounce. U.S. gold futures gained 0.21% to $1,771.80 an ounce.

Mainland Chinese shares lost 0.8%, while Japan's Nikkei also shed 0.8% on position adjustments ahead of a long weekend. Both markets will be closed through Wednesday.

(Editing by Ana Nicolaci da Costa, Raju Gopalakrishnan, William Maclean; Editing by Toby Chopra and Frances Kerry)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">