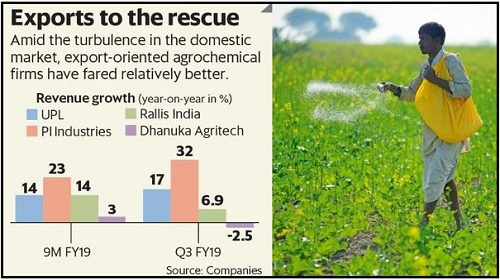

Why UPL, PI Industries scored over Rallis India, Dhanuka Agritech in FY19

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Now Get InvestmentGuruIndia.com news on WhatsApp. Click Here To Know More

Shares of agrochemical companies with higher exposure to overseas markets have done relatively better than those with less exposure in fiscal year 2019. This isn’t surprising given the challenges in the domestic agrochemicals market. “The industry has been impacted due to declining farmer income and low pest pressure. Inventory for the industry is ~20-30% higher than normal," Prabhudas Lilladher Pvt. Ltd said in a note released last month.

UPL Ltd and PI Industries Ltd gained 17-28% in FY19, tracking the 14-23% rise in revenues in the first nine months of FY19. In comparison, Rallis India Ltd and Dhanuka Agritech Ltd have lost between 28% and 30% of their value. These companies derive most of their earnings from India.

There are indications that the divergent performance may continue in FY20. Having said that, a low base and undemanding valuations mean Rallis and Dhanuka may be well placed for a rebound. Of course, all of this is provided the domestic business picks up.

An analysis by SBICAP Securities Ltd indicates continued recovery in the global agrochemical market. Growth at innovator companies is on an increase. With inventory at the distributors’ end reducing, the broking firm expects recovery to gather pace in 2019, providing pricing power to market participants.

“Innovators expect mid-single-digit revenue growth in 2019 with improving profitability. Price hikes and volume growth should help offset the adverse impact of high raw material cost and forex in 2019," said the SBICAP Securities note.

Some of this optimism was seen in the December quarter results. A ramp-up in exports helped PI Industries clock 32% revenue growth. UPL reported 17% growth, largely boosted by growth in Latin America. Comparatively, Rallis India clocked 6.9% growth, while Dhanuka’s revenues fell by about 2.5%.

Rallis India derives a fifth of its revenues from exports. So, a recovery in the global agrochemical market should benefit the company as well. However, much of its fortunes are intertwined with the Indian market, where tepid demand pushed up inventories and clouded the outlook for future sales.

The sharp rise in raw material costs is compounding the problem for local agrochemical sellers. Plant shutdowns related to pollution curbs in China crimped raw material supplies and drove up prices.

Export-oriented companies have withstood the pressure relatively better, because of greater backward integration. However, a strengthening rupee can negate this advantage to some extent, putting the onus on price hikes. How well the companies navigate this will be crucial. Besides, valuations of UPL and PI Industries, at 18 times and 34 times estimated FY20 estimates, respectively, are not cheap to own.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">