Weekly Technical Outlook: NIFTY INFRA 5205.25 weekly change (+2.50%) By Gepl Capital

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NIFTY PSU BANK

Observation

* NIFTY PSU BANK, is sustaining at multi-year high with the formation of Higher Top Higher Bottom on the monthly charts which indicates strong positive undertone of the sector for the medium to long term.

* Prices on weekly charts has given a Channel pattern breakout couple of weeks back which has been forming since November 2021.

* On the shorter time frame like daily, the Index has breached its previous swing top and sustained above that level in the latest trading session which confirms the short term trend is in line with the bigger picture.

* The momentum indicator such as RSI plotted on all the time frames like daily, weekly and month sustained above the 60 marks which shows an existence of a strong positive momentum of an Index for the medium to longer term.

Inference & Expectations

* Looking at the overall structure of the prices and the evidence provided by indicator we can infer that the texture of the trend is strong.

* Going ahead we expect prices to go till the level of 3492 (Year 2019 High) followed by 3750 (Swing High).

* Our bullish view would be negated if we see prices breaches below 2930 level.

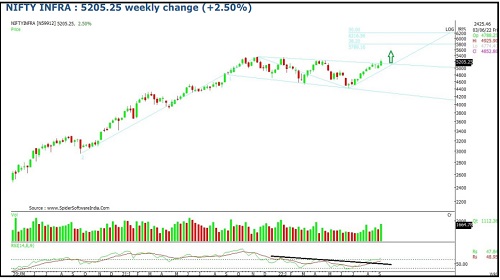

NIFTY INFRA

Observation

* On the monthly chart of the NIFTY INFRA, we can spot that prices are around 52 week high level which indicates that the prices have bullish undertone in it.

* In the latest week, Prices showed a breakout from the Downward Slopping Channel pattern indicating a beginning of a fresh uptrend.

* On the daily charts, the Index has made a CIP (Change in Polarity) pattern at 4970 levels which shows a strong positive sentiments of the Index as well as it defines a major support zone for the short to medium term.

* The RSI indicator plotted on all the time frames like daily, weekly and monthly has sustained above 60 marks indicating strong positive momentum of the Index for the medium to long term.

Inference & Expectations

* As per the overall chart pattern and indicator set up, it shows the existence of a strong bullish sentiments of the NIFTY INFRA for the medium to long term.

* We expect the prices to go higher till 5789 (38.2% Fibonacci Extension) followed by 6216 (50% Fibonacci Extension)

* Our Bullish view will be negated if we see prices breaches below 4970 level (Key Supports).

o Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://geplcapital.com/term-disclaimer

SEBI Registration number is INH000000081.

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

More News

Opening Bell: Markets likely to start new week in green