Weekly Oulook : Gold, Silver & Crude Oil By Anuj Gupta, IIFL Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views on Weekly Oulook - Gold, Silver & Crude Oil By Mr. Anuj Gupta, Vice President, IIFL Securities

Last week gold prices closed on a positive note. On MCX it closed 0.35% higher at 56875 levels and in the international market it closed on a flat note at $1827 levels. Silver prices closed on a flat to negative note down by 0.38% at 68331 levels. In the international market it closed down by 1.39% at $23.58 levels.

We have witnessed consolidation in bullions after data showed that the U.S. economy grew more than expected in the fourth quarter. Last week gold made a new high of 57125 levels on MCX.

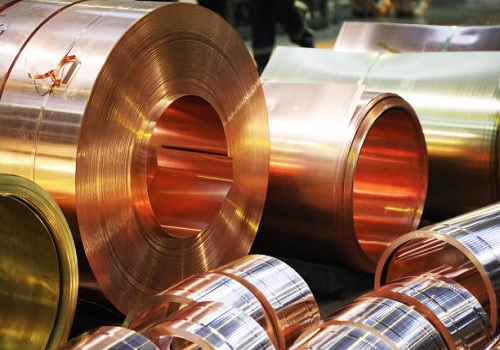

A mix of safe haven demand and expectations of less severe U.S. interest rate hikes boosted gold over the past six weeks, with the yellow metal now recouping most of its losses through 2022. Expectation from Chinese demand for industrial and precious metals is too supportive for the gold, silver and industrial metals.

Technically the trend of gold and silver are positive. Gold has a support at 56500 ($1920) and then 56200 ($1900) while resistance at 57200 ($1950) and then 57600 ($1985). We are expecting that gold may test 57200 ($1950) levels very soon. If trader and close above $1950 levels then it may test $1980 levels. Silver has a support at 67000 and then 65500 levels while resistance at 69500 levels and then 71000 levels. Silver may test 69000 to 69500 levels very soon.

Crude Oil

Last week Brent crude oil prices corrected by 1.37% and closed at $86.71 per barrel. It settled lower due to Russian oil supply last week. Oil loadings from Russia's Baltic ports are set to rise by 50% this month from December as sellers try to meet strong demand in Asia and benefit from rising global energy prices. Higher supplies are indicating the probability of more correction in crude oil prices, while demand from chinese and robust US economic data may support the crude oil prices. On MCX it corrected by 1.69% and closed at 6505 levels.

Technically Crude oil has a support at 6300 levels and 6100 levels while resistance at 6700 and then 6900 levels. We are expecting that Brent may trade between $81 to $88 levels.

Above views are of the author and not of the website kindly read disclaimer

More News

Crude oil weekly update : Brent corrected by 9.22% in last week Says Mr. Anuj Gupta, IIFL Se...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">