Weekly Commodity Outlook Of 20-02-2021 By Swastika Investmart

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

FUNDAMENTALS OF COMMODITY:

GOLD

* Gold prices advanced for a second straight day on Friday, halting a six-day slide that took it to June lows. Despite the yellow metal's ability to staunch more bleeding, support for the so-called inflation hedge and safe haven was feeble at best, say commodities strategists and those who spend their day studying variables and potential direction for gold.

MCX GOLD CHART

Technical indicators (Daily):

* RSI- 29.81

* MACD- -894

* MOVING AVERAGES (20,50,100)- (47720/48975/49607)

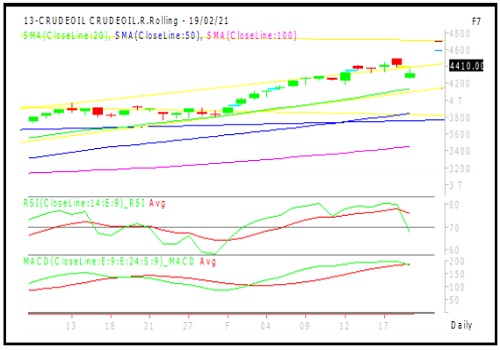

CRUDE OIL

* he severe winter storm that swept through the United States this week likely shut in between 2 million barrels per day (bpd) and 4 million bpd of the total U.S. crude oil production, IHS Markit said in an analysis. The Texas Freeze, which started in Texas and moved east across much of the U.S., has also impacted almost 6 million bpd of refining capacity, including 5.2 million bpd of the capacity in the Gulf Coast and 730,000 bpd of refining capacity in the Midwest.

Technical indicators (Daily):

* RSI- 67.57

* MACD- 182

* MOVING AVERAGES (20,50,100)- (4132/3843/3448)

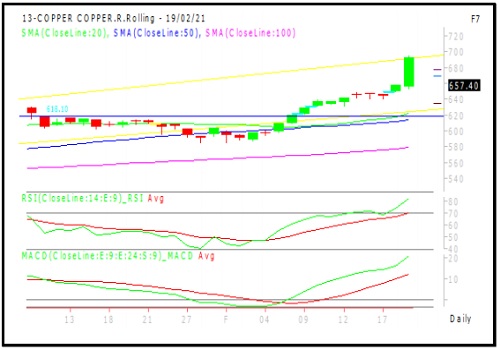

COPPER

* Copper prices continued to soar on Friday, surpassing the nine-year peak seen during the previous session, as bullish sentiment towards base metals resumed after the Chinese New Year. While copper’s ascent may be an indicator of higher demand, some market analysts believe it may have been squeezed on the supply side too.

Technical indicators (Daily):

* RSI- 81.86

* MACD- 20.95

* MOVING AVERAGES (20,50,100) -(622/614/579)

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.swastika.co.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">