We started off the week with a downside gap due to the weekend lockdown - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (49591) / Nifty (14835)

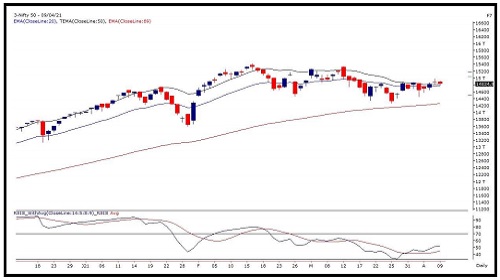

During the last week, trading started on a sluggish note on Monday morning as indicated by the SGX Nifty. However things worsened as the day progressed to test sub-14500 levels. Fortunately, there was no further damage done as we witnessed a gradual recovery throughout the remaining part of the week to reclaim the 14800 mark on a closing basis; but ended with a negligible loss as compared to the previous weekly close. Overall if we see, major indices have gone nowhere as it was a week of boredom and consolidation for them.

There were one or two odd days when we witnessed some action in index heavyweights; but didn’t last too long as breakout attempts on either sides were turned unsuccessful. In the upward direction, we were seeing 14900 as a crucial hurdle on a closing basis and after nearly twelve trading sessions, bulls attempted to break this barrier on an intraday basis; but failed to maintain at the close.

So 14900 – 15000 continues to remain a sturdy wall and till the time we do not surpass it, major heavyweights are not going to give any sustainable up move. Yes, at the same time, it’s not falling either; in fact the undertone remained bullish for the major part of the week. On the lower side, 14700 followed by 14550 are to be seen as immediate supports.

The deciding factor in days to come has to be the financial space. Since last couple of weeks, the banking index has been hovering around its strong support zone of 32200 – 32400 which is the breakout point on the budget day as well as the ’89-EMA’ on daily chart. It has managed to hold this till now and if any recovery has to take place, there will not be a better place than this.

But in our sense, if any bottom (short or long term) is to be formed; it does not give so many opportunities for the bulls to get in as it has been giving in last few days. It just happens in a flash and takes off before anyone could realize.

This is clearly not the case at present and hence, the more it challenges any particular support, the higher it creates possibility of breaking it. Hence, all eyes would be on this development as it is likely to dictate the near term direction for the market. Throughout this week, lot of thematic moves kept buzzing and hence, one can definitely keep tracking such potential candidates; but avoid being complacent at the same time.

Nifty Daily Chart

Nifty Bank Outlook - (32448)

We started off the week with a downside gap due to the weekend lockdown announced amid COVID surge. Post opening, strong selling pressure was seen from the word go to drag index below the recent lows of 32415. As the week progressed, we saw few attempts of recovery but 33200-33300 acted as a supply zone. Any pull back move was being sold into and eventually we concluded the week with a major cut of four percent.

As far as technical chart structure are concerned, the banking index has been hovering around the crucial ‘Make or Break’ level of 89EMA on daily chart which is placed around 32200-32400. Except for Thursday, almost daily BankNifty made an attempt to breach the important support zone but managed to sustain above same on the weekly close. We have been mentioning in the daily article, at how important levels is banking index placed and shall decide the further trend for market.

Considering the price action in the week gone by, we are a bit skeptical as in any bottom formation the recovery happens too fast to actually realize which is not the case this time. This is indeed not a very healthy sign for Bulls, hence, we would preferred being light in market and keep a close watch how things pan out in next 2-3 sessions.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Market Wrap Up : Market finally finds its mojo back, Nifty reclaims 17250 Says Mr. Sameet Ch...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">