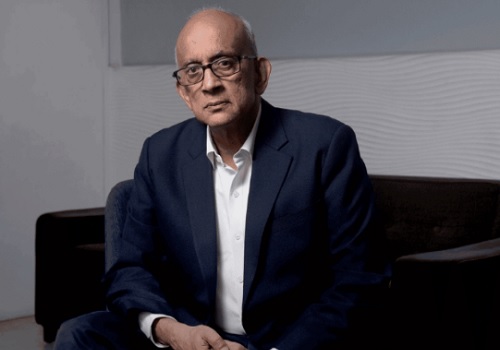

View on RBI Monetary Policy December 2021 By Shanti Ekambaram, Kotak Mahindra Bank Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are View on RBI Monetary Policy December 2021 by Shanti Ekambaram, Group President - Consumer Banking, Kotak Mahindra Bank Ltd

“In line with expectations, the MPC left the key rates unchanged and its stance continues to be “accommodative”. The MPC acknowledged that the economic recovery is becoming broad-based thanks to increased vaccination and a slump in COVID cases. While rural demand is likely to stay resilient, pent-up demand will continue to bolster urban consumption. Having said this, the RBI also pointed out that the economy may face downside risks from volatile commodity prices and financial markets, persisting global supply disruptions, and new mutations of the virus. RBI retained both the GDP estimate at 9.5%, and the inflation target at 5.3% for FY21-22. This is assuming that there would be no fresh spurt in COVID cases.

The MPC will use liquidity and other tools at its disposal to maintain price stability and continue to support the nascent but firm economic growth. The RBI has stated that they will provide continued policy support to economic growth. The RBI will continue to balance economic growth and inflation and watch global events and domestic data for further policy outlines and interventions.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">