Trade deficit touches record $22.6bn; WPI softens to 10.7% in Sep`21 - ICICI Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Trade deficit touches record $22.6bn; WPI softens to 10.7% in Sep ’21

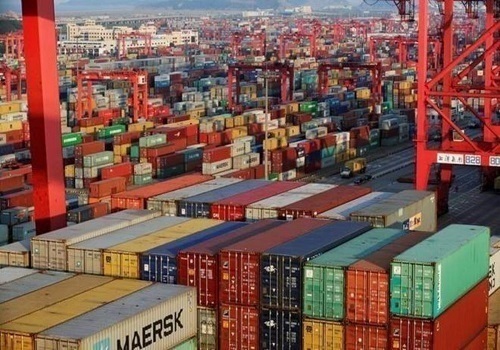

* Surging petroleum prices push India’s imports to record $56.4bn in Sep ’21...: India’s imports surged 85% y/y (albeit on a low base) to record high of $56.4bn in Sep ’21. In Aug ‘21 and Sep ’20, imports stood at $47bn and $30.5bn respectively. All categories of imports recorded sharp growth in y/y terms in Sep ’21, mainly because imports had contracted 19% in the corresponding period last year. However, one category viz. petroleum accounted for lion’s share in the high import growth.

Petroleum imports came in at whopping $17.4bn in Sep ’21, growing almost 200% y/y and 50% m/m. The main reason behind the sharp increase in petroleum imports is rising oil prices. The price of Indian basket of crude oil jumped to $73/barrel in Sep ’21, up 76% y/y. This trend has continued in the current month as well: in the first half of Oct ’21, oil prices are up 97% y/y. Hence, we expect to see continued surge in petroleum imports in the near future.

* …while exports remain broadly unchanged on sequential basis…: Exports, on the other hand, increased 22.6% y/y to $33.8bn in Sep ’21. In m/m terms, exports increased a modest 1.5%. In line with recent trend, engineering exports continued driving headline export growth. In Sep ’21, engineering exports increased 37% y/y to $9.4bn, reflecting robust investment activity in many parts of the world. Also, petroleum exports jumped 48% y/y to $5.2bn, boosting headline export growth. Out of the total increase in trade deficit of $19.6bn (from $2.9bn in Sep ’20 to $22.6bn in Sep ’21), rising imports contributed $25.9bn while higher exports subtracted $6.2bn.

* Increase in NONG imports much smaller at 41%: Compared to headline import growth of 85% y/y, increase in non-oil non-gold imports was much smaller at 41% y/y in Sep ’21. This shows that the economic health is not as strong as headline import numbers suggest. In the recent past, the gap between headline import growth and NONG import growth has widened due to high petroleum and gold imports. In Sep ’21, gold imports surged 750% y/y to $5.1bn (albeit on a low base of -53% y/y) as the upcoming festive and wedding season kept demand for the yellow metal high.

* Core exports grow 19% y/y in Sep ’21; labour intensive exports grow 20%: Core exports (ex-petroleum and gems & jewellery) grew 18.8% in Sep ’21, indicating there is not much of a froth in export growth. Labour intensive exports (leather + gems & jewellery + textiles) also grew broadly in line with headline exports, recording a growth of 20% y/y in Sep ’21.

* Wholesale inflation softens to 10.7% y/y in Sep ’21 mainly due to base effect: In a separate data release, the wholesale inflation softened to 10.7% y/y in Sep ’21, down from 11.4% in the preceding month but sharply up from 1.3% twelve months ago. With this print, average wholesale inflation in Q2FY22 stands at 11.2% while in H1FY22 it is 11.6%. Our analysis shows that out of the sequential decline of 73bps during Sep ’21 and Aug ’21, base effect shaved off 70bps while month-on-month momentum added ~7bps. Hence, the sequential decline was largely due to statistical effect and does not represent genuine softening of prices.

* Fuel inflation continues to decline; manufactured products inflation still elevated: From the component perspective, primary articles, fuel and manufactured products recorded 4.1%, 24.8% and 11.4% inflation respectively in Sep ’21. Although fuel inflation has been softening steadily since Jun ’21, manufacturing inflation has remained elevated, printing above 11% for the fifth consecutive month.

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings