The weakness in the global bourses led to a weak start of our equity market - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

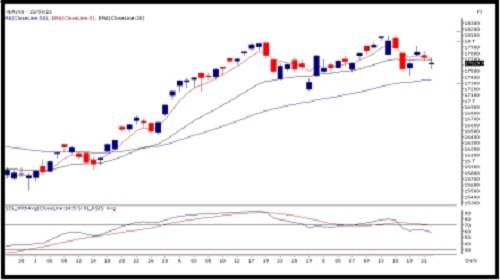

Sensex (59120) / Nifty (17630)

The weakness in the global bourses led to a weak start of our equity market, wherein the benchmark index initiated the day with a gap down. The sell-off further aggravated and dragged the Nifty index towards 17530 odd zone. However, the bulls retaliated from the sacrosanct support and made a modest recovery to pare down the losses. With such hustle in the market, the benchmark index Nifty50 concluded the day in red with a cut of 0.50 percent, a tad above the 17600 zone.

On the technical perspective, the crucial support of the 17500 was firmly safeguarded, implying the resilience of the technical support. However, some tentativeness was seen in our domestic market during the weekly expiry session. And as we advance, any sign of respite from the global bourses could trigger strong momentum from hereon. In terms of technical levels, any breach below the mentioned support could drag the market towards the 17400- 17380 zone, which is likely to be seen as the sheet anchor. At the same time, on the higher end, the 17750-17800 could be seen as immediate resistance, followed by the 17850-17900 zone.

Nifty Bank Outlook (40631)

Bank Nifty started around the previous session low and post a modest recovery in the first hour it slipped again to mark an intraday low of 40360. The action was not done yet on the weekly expiry day as we witnessed a wild swing on both sides of trend to eventually end with a loss of 1.39% at 40631.

Yesterday, during the mid-session there was some respite in the broader markets however the banking space remained under pressure and intraday bounce got sold into. On hourly charts, we are witnessing a Symmetrical Triangle breakdown as mentioned in our yesterday's report and momentum somewhat seems to have shifted on the bears side. The prices have still managed to defend the key support of 40300 levels and if broken would activate the Shooting Star bearish pattern seen on the weekly chart. Going ahead, 40300 is a make-or-break level for the near-term trend for the banking space and one needs to closely watch how markets react around the said levels. On the flip side, 41000 - 41250 is the immediate resistance.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One