The rupee may continue in its depreciation mode amid strong dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

* The dollar slipped by 0.27% on Friday as traders pared back bets on the interest rate hike cycle and brought forward their outlook on the timing of rate cuts to counter a possible recession. However, further downside was cushioned by strong economic data. New home sales in the US rose 696,000 in May, above market expectations of 588,000

* US$INR futures maturing on June 28 dropped by 0.04% on Friday amid an uptick in Indian equities

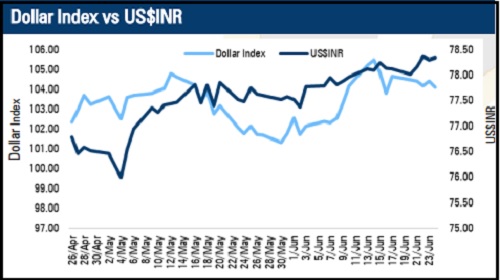

* The rupee may continue in its depreciation mode amid strong dollar. Further, the rupee may be pressurised by persistent foreign funds outflows. Moreover, investors will closely watch core durable goods orders as it is expected to rise from 0.4% to 0.6%. However, sharp downside may be prevented by falling crude oil prices. As long as US$INR (June) sustains above 78.10 level it may rise further till 78.50 level

Dollar Index Vs US$INR

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

Momentum oscillator, RSI has been heading south showing bearish momentum - HDFC Securities

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">