The rupee is expected to depreciate today on the back of a strong dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

•The US dollar rallied amid upbeat economic data from the US and as hawkish statements from Fed officials reinforced expectations on aggressive monetary tightening. New York Fed President John Williams said 0.5% rate rise next month was a very reasonable option

• Rupee future maturing on April 27 ended flat on Wednesday. The rupee tracked a firm dollar and weak global market sentiments. Additionally, disappointing economic data from India and a surge in crude oil prices added downside pressure to the rupee

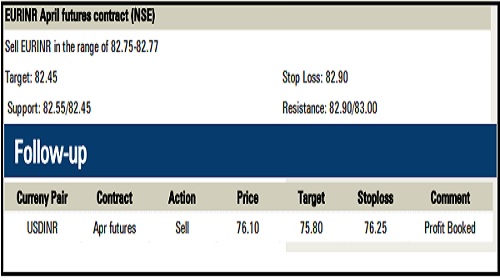

• The rupee is expected to depreciate today on the back of a strong dollar and risk aversion in global markets. Market sentiments were hurt as red hot inflation led to the worries that major central banks across the globe will reduce their support aggressively. Additionally, persistent FII outflows and surge in crude oil prices will hurt the rupee. US$INR (April) is holding support level of 76.10. As long as it sustains above this level it may slip further till 76.55

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Top News

HDFC Asset Management Company AMC announces revision in Provisions pertaining to LBMA reference

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

EURINR has fallen from the highs and sell on rise is recommended near 89.30 for tgt of 88.90

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">