The rupee is expected to depreciate today on strong dollar and elevated crude oil prices - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

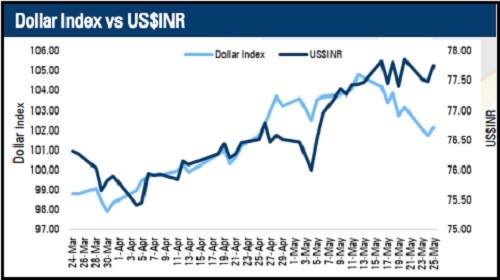

* The US dollar advanced by 0.37% yesterday as the FOMC meeting minutes showed that most policymakers feel the central bank should hike rates by 50 bps in June and July. Further, officials discussed the possibility that they would raise interest rates to levels high enough to slow economic growth deliberately as the central bank races to combat high inflation. However, sharp upside was capped as US durable goods orders for April increased 0.4%, a slower pace than expected

* Rupee future maturing on May 27 depreciated marginally by 0.04% amid strong dollar, weak domestic markets and consistent FII outflows

* The rupee is expected to depreciate today on strong dollar and elevated crude oil prices. Furthermore, market participants fear that tightening of monetary policy across major countries in globe to combat high inflation, may prompt foreign investors to pump out liquidity from emerging markets. US$INR (May) is expected to trade in a range of 77.45-77.75

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">