Petrol at Rs 75 and diesel Rs 68 a litre in FY22 if taxation shifts to GST: SBI Ecowrap

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

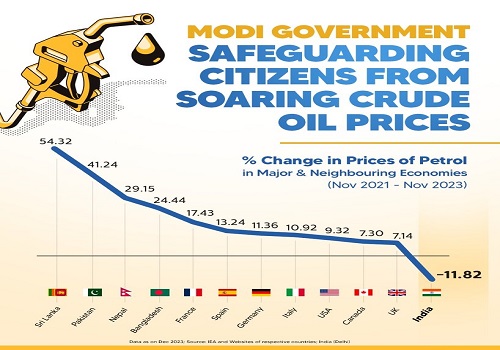

Consumers can be spared from a rally in retail prices of petrol and diesel if the two auto fuels are brought under the GST regime, but lack of political will and hesitancy to let go a major source of revenue for governments is keeping the product prices one of the highest in the world, economists at SBI said on Thursday.

According to them, petrol prices could be as low as Rs 75 a litre and diesel Rs 68 a litre if the two fuels are brought under a uniform taxation system that GST provides.

The economists put across their views in the SBI Ecowrap report, which said that lower prices for petrol and diesel assume that crude oil is priced at $60 a barrel and the exchange rate is Rs 73 per dollar.

They said under the model made by them, the Centre and the states have a revenue deviation from budget estimates by only Rs 1 lakh crore or 0.4 per cent of GDP after adjusting for the increase in consumption with the intended price cut, but the relief offered to the consumers would be 'enormous'.

Retail prices of petrol and diesel have been moving up steadily this year, reaching new highs with every increase. It has risen on 26 days this year with petrol rising by 7.46 per litre to climb to Rs 91.17 a litre in Delhi, while diesel increased by Rs 7.60 per litre to reach Rs 81.47 in the national capital.

The SBI Ecowrap report in its model on retail price for petrol and diesel under GST regime has also assumed (after assumptions on crude prices and dollar rate) transportation charges at Rs 7.25 for diesel and Rs 3.82 for petrol, dealer commission of Rs 2.53 for diesel and Rs 3.67 for petrol, cess of Rs 30 for petrol and Rs 20 for diesel, which will be divided equally between the Centre and the states, and GST rate at 28 per cent (also equally divided between states and Centre).

It has also taken into account growth in consumption of petrol by 10 per cent and that of diesel by 15 per cent in FY22 to arrive at fuel pricing and revenue loss figures.

Under this model, the economists said that uniformity of taxes is ensured across the country while it also brings down the burden of taxes on the common man by almost Rs 10-30 depending on the product consumed and the state in which it is consumed. Additionally, it benefits some states which do not drastically tax their petroleum products, such as Uttar Pradesh.

The model developed by the economists at SBI has also calculated that an increase of $1 in crude oil prices will push up petrol price by around 50 paise and diesel price by around Rs 1.50, and bring down the overall revenue loss for governments by around Rs 1,500 crore under the baseline scenario.

The states, which have the highest share of tax revenues at present, will be the biggest losers if the system shifts to GST, it said, adding that such a move will help the consumers pay up to Rs 30 less.

Interestingly, the report suggests that when crude oil/bbl declines by $10, the and the states could save close to Rs 18,000 crore, if they keep petrol prices at baseline Rs 75 and diesel at Rs 68 and don't pass on the benefits to the consumers. This is higher than the savings at Rs 9,000 crore, when crude prices go up by $10/bbl and if in the same vein the increased prices are not passed on.

"We thus recommend that the government builds up an oil price stabilisation fund which can be used in bad times for compensating revenue loss by cross subsidising funds saved from good times," the report said.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">