The rupee continued to appreciate and made a new one year high - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Futures

* The rupee continued to appreciate and made a new one year high. It gained 4 paise on Tuesday to close at 72.46

* For a second day in a row, the Dollar index continued to hover near 90 levels. Housing data, Fed Chair Powell’s testimony, consumer confidence would be watched closely, which may trigger some volatility.

Global Bonds

* The Nifty ended with minor gains amid high volatility. Sectorally, action was seen in metals and realty stocks while profit booking was seen in banks and financial services. According to option chain, 14700 Call and Put has noteworthy OI. Hence, we expect the Nifty to remain in a range of 14600-14800

* The Bank Nifty fell for six consecutive days on the back of selling pressure in private banks. However, 35000 Put base acted as support

FII & FPI Activities

* Foreign institutional investors (FII) remained net sellers to the tune of | 1289 crore on February 19, 2021. They sold worth | 493 crore in the equity market and sold worth | 796 crore in the debt market.

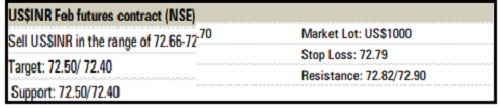

US$INR futures on NSE

* The US$INR appreciated whereas future fell 10 paise and ended marginally above 72.54 levels ahead of the expiry. We continue to believe that the rupee would appreciate and move towards 72.3 levels

* The dollar-rupee February contract on the NSE was at | 72.54 in the last session. The open interest fell almost 10% in the February series.

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">