The nifty index slipped to the levels of 14265 - Choice Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

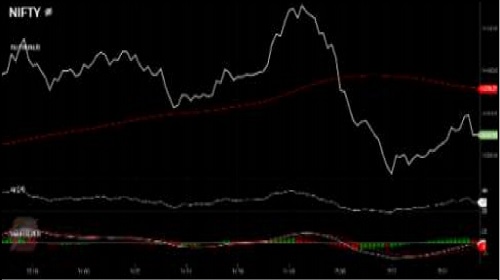

*The benchmark index plunged further consecutively for the second day, on the back of weak global sentiments and increasing corona numbers in the country. After a flat opening, the nifty index slipped to the levels of 14265 and closed the session at 14324.90 with a loss of 224.50 points.All the sectoral indices came under selling pressure and settled in red, whereas the Nifty IT, Auto, Energy & Smallcap dropped more than 2% in a day. Despite a one-way fall in the market, a few stocks like TATASTEEL, ICICIBANK, DREDDY have supported Nifty with some gains while |OC, MARUTI, HINDUNILVR were the top losers for the day.

*Technically, on the daily chart Index has given breakdown of Double Top formation which is a bearish reversal pattern and suggests a downside movementin the counter.

*Furthermore, the Index has a given closing below 21-Days Moving Averages, which points out weakness inthe counter.

*At present, the nifty index has a strong support at 14250 levels, breaching below it can show 14000 levels while an upside resistance comes at 14750 levels.

Bank Nifty

*Onthe daily charts, The Bank nifty Index closed at 33006.45 with a loss of 286.85 points

*Moreover, the stock has been trading below its 21 Days Moving Average which is placed at 34711 level which shows negative momentum in the stock.

*Furthermore, The MACD indicator on daily basis has given negative crossover which pointsout for a negative trend in the Index.

*At Present in the Index has support comes at 32700 level while resistance comes at 34000 level.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

More News

Nifty opened on a flat note and remained in a small range throughout the day - Jainam Share ...