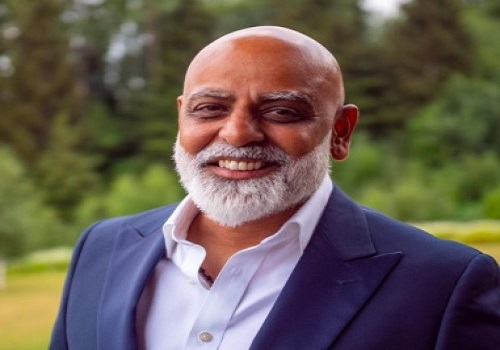

The inflation and growth trajectory will guide the moves by the RBI Says Mr. Nish Bhatt, Millwood Kane International

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below Perspective on RBI MPC announcement By Mr. Nish Bhatt, Founder & CEO, Millwood Kane International

After hiking rates cumulatively by 250 bps the RBI took a pause in today's monetary policy review meeting. This also re-affirms the view that the decisions by the RBI are data-driven. The economy is expected to grow at 7% for FY23. Inflation is moderating and most deficits - fiscal and current are pretty much under control. The surprise move will give an opportunity to the RBI to monitor the impact of the previous steps on inflation and growth and then decide on the next steps. Though the RBI stated that they will remain nimble in their approach, but we believe that this is the end of the rate hike cycle.

Moving forward too, the inflation and growth trajectory will guide the moves by the RBI. A good monsoon year, inflation in the range of 2-6%, and growth above 7% will not only help RBI keep rates on hold but also encourage them to start cutting rates by the start of CY24.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">