The index started the week on a negative note and drifted southward as intraday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: 17149

Technical Outlook

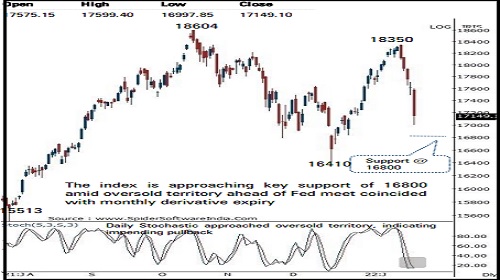

• The index started the week on a negative note and drifted southward as intraday pullbacks remained short lived. Contrary to our expectation, the selling pressure accelerated on the beach of Friday’s Doji candle’s low (17485), leading the Nifty to settle below 17200 mark. As a result, daily price action to formed a sizable bear candle carrying lower high-low, indicating extended correction

• The formation of lower high-low signifies prolonging of corrective bias. Going ahead, we believe strong support is placed in the vicinity of 16800. Key point to highlight is that, the sentiment indicator (advance/ decline) has approached extreme oversold reading. Historically, such oversold reading eventually triggers technical pullback in coming sessions. Even the daily stochastic oscillator (placed at 12) has approached oversold territory ahead of key global event of Fed meet coincided with monthly derivative expiry. Thus, Nifty holding above 16800 amid elevated global volatility in coming sessions would lead to technical pullback towards 17600 mark as it is confluence of:

• a) 50% retracement of ongoing corrective phase (18350-16998)

• b) current week’s high is placed at 17599

• The broader market indices mirrored the benchmark’s move and extended secondary correction over fifth consecutive week. We believe, the ongoing correction in the vicinity of 100 days EMA would help Nifty Midcap and small cap indices to undergo healthy consolidation and form a higher base that would pave the way for next leg of up move

• Structurally, breach of previous week’s low signifies pause in upward momentum. The secondary correction is part of the secular bull market that set the stage for acceleration in momentum of prevailing up trend. In current scenario, we expect strong support for the Nifty is placed at 16800 as it is 80% retracement of December-January rally (16410-18350), placed at 16798 In the coming session, the index is likely to open on a negative note amid weak global cues. The index is expected to find support around 80% retracement of the entire previous up move (16400-18350). Hence use intraday dips towards 16838-16862 for creating long position for the target of 16948

Nifty Bank: 36947

Technical Outlook

• The price action formed a sizeable bear candle with lower high -low indicating extended correction as selling pressure accelerated once 37000 level was breached leading index to settle below 50 day moving average (currently placed at 36770), contrary to our expectations

• Going forward, bias would remain corrective as long as index continues to form lower high -low formation . Next key support for Bank Nifty is placed around 35800 -36000 levels which is 61 . 8 % Fibonacci retracement of the entire up move of past one month (34018 -38855 )

• Holding key support of 35800 -36000 levels in coming sessions would lead to a technical pull back towards 38000 as index has approached oversold readings ahead of key events . 38000 mark is key resistance in the short term as it is confluence of a) last Friday’s breakdown area and 61 . 8 % retracement of past five session decline (38855 -36375 )

• In the coming session, index is likely to open on a negative note amid weak global cues . The index is expected to find support around 50 % retracement of the entire previous up move (34123 -38965 ) . Hence use intraday dips towards 36430 -36490 for creating long position for the target of 36740 , maintain a stop loss at 36310

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct