The index is undergoing breather after a sharp rally of 1100 points in just six sessions - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Nifty : 17675

Technical Outlook

• The index witnessed a lacklustre movement as Nifty oscillated in just 130 points range. As a result, daily price action formed an inside bar, indicating range bound activity amid stock specific action as index failed to witness follow through strength above Friday’s high (17842). In the process, broader markets outperformed the benchmarks as Nifty midcap gained 0.6%

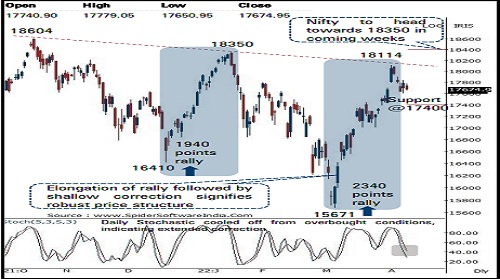

• The index is undergoing breather after a sharp rally of 1100 points in just six sessions. Going ahead, we expect the Nifty to prolong the consolidation in the broader range of 18000-17400 amid stock specific activity as we enter the Q4FY22 earning season. The formation of higher peak and trough on the larger degree chart signifies the broader positive structure still remains intact. However, due to ongoing global volatility our target of 18350 has been delayed. Therefore, dips from hereon should be used as a buying opportunity as we do not expect index to breach key support threshold of 17400

• The broader market indices continued to outperform the benchmark and accelerated catch up activity with its large cap peers. The midcap index has logged a resolute breakout from six month falling channel. Further, this rally is backed by improving market breadth as the percentage of stocks above 50-DMA of the Nifty 500 universe has soared to 77% compared to mid February (Russian invasions on Ukraine) swing high reading of 25%, indicating inherent strength that augurs well for durability of ongoing up move going ahead.

• Structurally, during ongoing up move off march low of 15671, index has arrested secondary correction within 61.8% retracement of prevailing up move. In the current scenario as well we expect index to maintain same rhythm. Thus wee expect, Nifty to hold the key support of 17400 as it is 61.8% retracement of current up move (17004-18114), placed at 17428 In the coming session, index is likely to witness gap down opening tracking weak global cues. The beach of past three sessions low (17650) signifies extended correction. Hence, use intraday pullback towards 17662-17692 for creating short position for target of 17576

NSE Nifty Daily Candlestick Chart

Nifty Bank: 37613

Technical Outlook

• The daily price action formed a bullish Inverted Hammer like candle with a higher high -low signaling continuation of the last five sessions consolidation at the last Monday’s gap up area (37148 -37665 ) signaling higher base formation after a sharp rally of more than 3500 points up move in just six sessions .

• In the smaller time frame the index has already taken five sessions to retrace just 38 . 2 % of the preceding six sessions up move (35016 -38765 ) . A shallow retracement signals a higher base formation and an overall positive price structure

• Going ahead we expect the index to continue with its up move and gradually head towards February 2022 high of 39400 levels in the coming weeks

• Buy on dips strategy has worked well during the recent up move, which is likely to continue, hence the current breather of the last five sessions should not be seen as negative instead should be used as buying opportunity as we do not expect Nifty to breach support area of 37100 -36700 being the confluence of the following observations : • (a)last Monday's bullish gap up area placed around 37100

• (b) The recent breakout area above last two weeks high is placed around 36700 levels

• Among the oscillators the weekly 14 periods RSI has recently generated a buy signal moving above its nine periods average thus validates overall positive bias in the index In the coming session, index is likely to open on a negative note tracking weak global cues . We expect the index to continue with its last five sessions corrective consolidation . Hence after a negative opening use intraday pullback towards 37620 -37700 for creating short position for the target of 37360 , maintain a stoploss at 37810

Nifty Bank Index – Weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

After opening with a negative note, the market moved swiftly up in the early part of the se...