The index has strong support around 39800 levels as it is the confluence of the 20 days - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

Technical Outlook

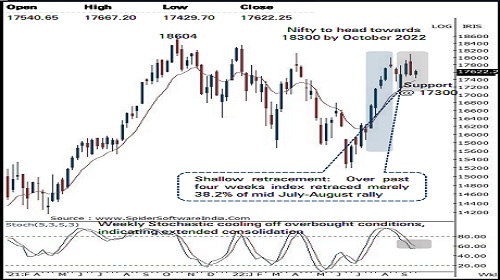

• The Nifty started the week on a subdued note. However, buying demand from 61.8% retracement of past two week’s up move (17166-18096) helped the index to recoup intraday losses and end the session above 17600. The daily price action formed a bull candle with lower shadow, indicating buying demand at elevated support base. The index in the process maintained the rhythm of not correcting more than three sessions in a row seen since June 2022

• Going ahead, we expect Nifty volatility to remain high ahead of Fed meet outcome wherein the index would consolidate and form a a higher base to pave the way towards January 2022 high of 18300 by October. In the process, strong support is placed at 17300, which we do not expect to get breached. The index is undergoing healthy consolidation, which will help to cool off overbought conditions (daily and weekly stochastic oscillator cooled off to 22 and 56, respectively). Empirically, secondary correction is an integral part of the bull market that paves the way for the next leg of the up move. Thus, ongoing breather should not be construed as negative. Instead dips should be capitalised on to accumulate quality stocks. Our positive stance on index is based on following observation:

• a) Over past four weeks, the index has undergone slower pace of retracement by retracing merely 38.2% of mid July-August rally (15850-18000), thereby making market healthier

• b) Brent crude prices continue to trend downward after breaking their two-year support trend line. In coming weeks decisive break below 86 would lead further declines

• c) Indian equities continue to relatively outperform in the face of global volatility. Nifty 500 ratio against S&P 500 has given a breakout from decade long consolidation underscoring relative outperformance ahead

• Structurally, we expect extended breather from hereon would get anchored around 17300 mark as it is 80% retracement of recent 11 sessions rally (17166-18096) coincided with 50 days EMA placed at 17314

• In the coming session, index is likely to open with a positive gap tracking firm global cues. We expect the index to trade with positive bias while forming higher high-low. Hence after a positive opening use intraday dips towards 17680-17712 for creating long position for the target of 17797

Nifty Bank

Technical Outlook

• The daily price action formed a small bull candle which mostly remained contained inside previous session price range signaling consolidation after last two sessions corrective decline ahead of the FOMC rate decision on Wednesday . The index in the process maintained the rhythm of not correcting more than two consecutive sessions baring one instance since June 2022

• Going ahead we expect the index to maintain positive bias and head towards 41800 levels . Dips on account of global volatility should not be construed as negative rather should be used as a buying opportunity . Index has strong support around 39800 levels .

• Structurally, the index has witnessed a faster retracement as eight month’s decline (41829 -32990 ) was completely retraced in just two and half months highlighting overall positive bias .

• In the weekly time frame after a strong rally of 29 % in just 13 weeks, index has approached overbought territory with a weekly stochastic reading of 81 . Hence, temporary breather cannot be ruled out after the recent strong outperformance which will make the overall trend healthier

• Bank Nifty continue to relatively outperformed the benchmark index in the last few quarters as can be seen in the Bank Nifty/Nifty ratio chart . It has recently generated a breakout above last 15 month’s range . Within the banking stocks PSU banking stocks has been resilient and showing relative strength . We expect the current outperformance to continue going forward

• The index has strong support around 39800 levels as it is the confluence of the 20 days EMA (currently placed at 39860 ) which has acted as strong support in the entire up move of the last two months and the 50 % retracement of the last three weeks up move (37944 -41840 )

* In the coming session index is likely to open on a positive note amid firm global cues . We expect the index to trade with positive bias while forming higher high -low . Hence after a positive opening use intraday dips towards 40980 -41060 for the target of 41330 , maintain a stoploss at 40870

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Morning Nifty and Derivative comments 25 May 2023 By Anand James, Geojit Financial Services

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">