The index has key support around 31500 -32000 levels - ICICI Direct

Nifty : 16240

Day that was… Equity benchmarks took a breather after Tuesday’s sharp up move. The Nifty lost 19 points to conclude Wednesday’s session at 16240. The market breadth remained positive with A/D ratio of 1.25:1. Sectorally, FMCG, pharma relatively outperformed while PSU Bank, reality took a breather.

Technical Outlook

• In line with our view, Nifty resolved higher and pulled back near immediate resistance of 16400. However, in the second half index pared initial gains as profit booking emerged from 16400 levels. As a result, the daily price action formed a small bear candle carrying higher high-low, indicating breather after Tuesday’s sharp up move.

• In the coming session index is likely to witness gap down opening tracking weak global cues. Going ahead, strong support for the Nifty is placed at 15600. We believe, for a sustainable pullback to materialize index need to form a higher base from here on amid oversold condition, else extension of corrective bias towards 15600 tracking volatile global cues. In the process, 16400 will be the key level to watch on the upside as it is the 38.2% retracement of past four weeks decline (17414-15735)

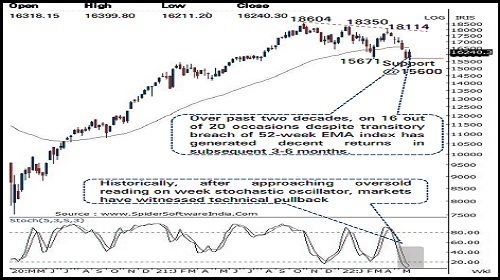

• Structurally, over past two decades, on 16 out of 20 occasions despite transitory breach (not greater than 5%) of 52-week EMA (currently 16560) index has generated decent returns in subsequent 3 month and 6 months. In current scenario 5% from 52 weeks EMA will mature at 15700. Although the short term trend remains down, structurally ongoing secondary correction is part of a retracement of CY20-21 rally. Hence, investors should use current weakness to their advantage and focus on constructing portfolios of quality companies in staggered manner. Going forward, strong support is placed at 15600 as it is confluence of:

• A) 61.8% retracement of CY21 rally

• B) equality of previous down leg of 14% projected from April high of 18115

• In tandem with the benchmark broader market staged a pullback from oversold territory. Going ahead, we expect Nifty midap index to undergo base formation in the vicinity of 52 weeks EMA while sustaining above March low.

In the coming session, index is likely to witness gap down opening tracking weak global cues. we expect index to trade with corrective bias amid elevated volatility owing to weekly derivative expiry. Hence, use intraday pullback towards 16055-16080 for creating short position for the target of 15967

Nifty Bank: 34163

Day that was : The Bank Nifty traded in a narrow range and closed marginally lower by 0 . 4 % on Wednesday amid muted global cues . Private banking stocks consolidated in a range and closed marginally lower, while the PSU bank index closed down by 1 . 5 % . The Bank Nifty closed the session at 34163 levels, down by 138 points or 0 . 4 % on Wednesday

Technical Outlook

• The daily price action formed a small bear candle signaling consolidation after last two sessions up move . Index in today’s session is opening gap down amid weak global cues highlighting lack of follow through buying as the index is seen profit booking from near the previous week high (34793 )

• Going ahead, index need to maintain higher high -low on a sustained basis for a sizable pullback to materialize . Index has crucial support around 33000 levels being the last week low holding above which will keep the pullback option open . Failure to do so will led to an extended decline towards the March low (32155 ) .

• On the higher side index has stiff resistance around 35000 levels being the confluence of the bearish gap area of 6th May 2022 and the 38 . 2 % retracement of current decline (38765 -33927 ) .

• The index has key support around 31500 -32000 levels as it is confluence of :

• (a) March low placed at 32155

• (b) Equality with previous major decline of last 2 years signals support at 31500 levels

• Among the oscillators the daily stochastic is seen rebounding from the oversold territory and has recently generated a buy signal moving above its three periods average thus validates positive bias

In the coming session, index is likely to open gap down amid weak global cues . Index is seen facing profit booking around last week high, intraday bias remain down, hence after a gap down opening use pullback towards 33850 -33920 for creating short position for the target of 33580 , maintain a stoploss at 34030

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

More News

Stock Insights : Azad Engineering , HFCL, Page?Industries , Rail?Vikas?Nigam , Reliance?Powe...