The downside rally could be testing all the way up to 13750-13600 levels - Enrich Commodities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NIFTY MORNING OUTLOOK

Pre-Market Thursday! Asian market negative trading, Nifty50 on the SGX were trading lower higher at 13898.50 -85.75 points on indicating gap down opening for the NSE.

At the close in NSE, the Nifty 50 declined 1.91%, while the BSE Sensex 30 index fell 1.94%.

The biggest gainers of the session on the Nifty 50 were Tech Mahindra Ltd, which rose 2.62% or 25.50 points to trade at 997.55 at the close. SBI Life Insurance Company Ltd added 2.34% or 20.15 points to end at 883.00 and Wipro Ltd was up 2.00% or 8.75 points to 446.00 in late trade.

Biggest losers included Tata Motors Ltd, which lost 4.44% or 12.40 points to trade at 266.75 in late trade. Tata Steel Ltd declined 4.28% or 27.90 points to end at 624.05 and Titan Company Ltd shed 4.19% or 62.85 points to 1437.00. The breadth, indicating the overall health of the market, 1754 fell and 1036 advanced, while 134 ended unchanged on the India National Stock Exchange.

Rupee desk: The USD/INR was up 0.02% to 72.928.

Technical outlook

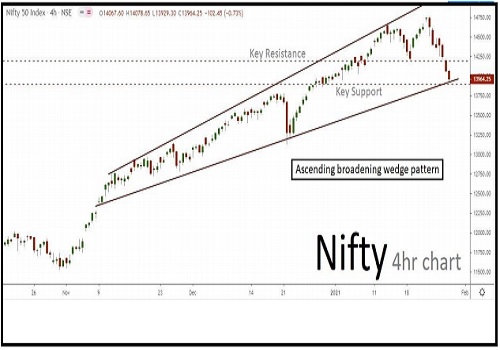

Nifty 4hr chart has formed "Ascending broadening wedge" pattern. The last few sessions ended up sideways mode along with some corrections inside the channel. The market is expected to continue on bearish momentum based on current price action, once the same break below the current key support holding near 13900. The downside rally could be testing all the way up to 13750-13600 levels in the upcoming sessions. Alternatively, if the market struggles to break the support, then it might retest the same and revise the trend to bullish/sideways mode once again. Key resistance holds near 14200. A slide to 14350 is also a possibility if the price makes or break above the current resistance level.

Technical Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://enrichbroking.in/disclaimer

SEBI Registration number is INZ000078632

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">