The daily price action formed a bull candle with a lower shadow carrying a higher high-low - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE Nifty

Technical Outlook

* The daily price action formed a bull candle with a lower shadow carrying a higher high-low, indicating a pause in downward momentum as the index managed to end above the immediate resistance of 14900

* Going ahead, follow through strength above Tuesday’s high of 14959 (on a closing basis) would be required to confirm the conclusion of the ongoing corrective phase. Failure to do so would lead to prolonging of ongoing consolidation in the broad range of 14900-14500 amid stock specific action as we expect the relative outperformance of broader markets to endure. We believe the ongoing healthy retracement is helping the index to form a higher base around 14500 mark and paving the way for the next leg of the up move. Hence, any decline from here on should be capitalised on to accumulate quality large cap and midcap stocks

* Key point to highlight during the past two weeks is that the Nifty midcap index has been evidently outpacing the benchmark by maintaining its record setting spree despite ongoing consolidation in the benchmark. Going ahead, we reiterate our constructive stance on the broader market. Hence, we expect further catch up activity to be seen in small caps as it is still 14% away from its lifetime highs

* Structurally, formation of higher peak and trough on the larger degree chart backed by strengthening market breadth signifies a robust price structure that makes us confident of revising the support base at 14500 as it is confluence of:

* a) Since May 2020, the index has not sustained below its 50 days EMA. Currently, the 50 days EMA is placed at 14432

* b) Price wise the index has undergone slower pace of retracement, as over past 11 sessions it retraced 50% of preceding 11 sessions up move (13597-15432), placed at 14514

* c) Time wise, secondary correction has not lasted for more than a week, since May 2020

* d) Last week’s panic low is placed at 14468 In the coming session, index is likely to open on a flat to positive note tracking firm Asian cues. We expect index to trade with a positive bias while maintaining a higher high-low formation. Hence, use intraday dip towards 14910-14938 to create long position for target of 15023

NSE Nifty Daily Candlestick Chart

Bank Nifty

Technical Outlook

* The daily price action formed a second consecutive high wave candle which remained enclosed inside Friday’s large bear candle signalling lack of follow through to Friday’s sharp sell off and buying demand at lower levels

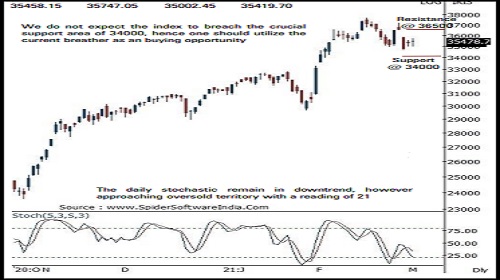

* The index over the past 11 sessions has retraced just 38 . 2 % of preceding 13 sessions sharp up move (29688 -37708), at 34645 . The slower pace of retracement signifies healthy retracement that helped weekly stochastic to cool off overbought conditions (currently placed at 70 )

* Going ahead, we believe the current breather should be used as an incremental buying opportunity as we do not expect the index to breach the key support threshold of 34000 . Hence, any dip from here on should not be construed as negative . Instead it should be capitalised on to accumulate quality banking stocks in a staggered manner

* Index require to form higher high -low in the daily chart on sustained basis and close above the immediate resistance of 36500 being the confluence of the last Friday’s bearish gap area and 61 . 8 % retracement of the of the recent decline (37232 -34659 ) to signal a resumption of fresh up move

* The key support threshold of 34000 , is the confluence of the following observations : a) The 50 % retracement of the budget rally (30906 -37708 ) placed at 34307 b)The price parity with the previous major correction (32842 -29688 ) as projected from the recent all time high (37708 ) signals major support around 34000 levels

* In the coming session, the index is likely to open on a positive note on the back of firm Asian cues . volatility would remain high owing to volatile global cues . We expect the index to continue with its previous two session pullback . Hence after a positive opening use dips towards 35210 -35280 for creating intraday long position for the target of 35490 , maintain a stoploss at 35110

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct