The daily price action formed a bear candle signaling profit booking after a strong pullback of more than 3500 points in just five sessions - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty : 16663

Technical Outlook

• The Nifty underwent profit booking amid overbought conditions of daily stochastic oscillator. As a result, index formed a bear candle carrying lower low, indicating pause in upward momentum after rallying more than 1200 points over past five sessions

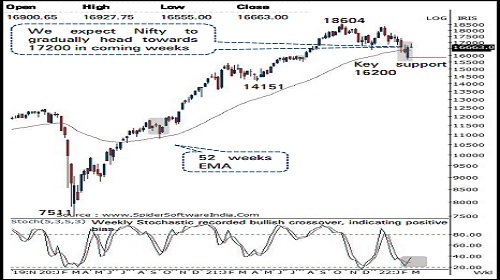

• Going ahead, we expect index to trade with a positive bias and gradually head towards 17200-17300 region in coming weeks as it is 61.8% retracement of January-March decline (18350-15672). Meanwhile, any global volatility amid Fed meet should note be construed as negative, instead dips from hereon should be capitalized as buying opportunity as we do not expect Nifty to breach the key support of 16200 in coming weeks.

• Structurally, index has maintained the rhythm of witnessing buying demand in the vicinity of 52-week EMA. Historically, temporary breach of not greater than average 5% from the 52 weeks EMA has subsequently seen decent returns in the following three to six months. The formation of higher highlow on the weekly chart signifies rejuvenation of upward momentum that makes us confident to retain support base at 16200 as it is 61.8% retracement of current up move (15671- 16927)

• The broader market indices have approached in the vicinity of 52 week EMA. We expect, the Nifty midcap and small cap indices to form a base around 52 weeks EMA in coming weeks that would set the stage for extended pullback

In the coming session, index is likely to witness gap up opening tracking firm global cues. We expect index to trade with a positive bias while sustaining above Tuesday’s low of 16555. Thus, any dip towards 16800-16832 should be used to create long position for target of 16919

NSE Nifty Daily Candlestick Chart

Nifty Bank: 35022

Technical Outlook

• The daily price action formed a bear candle signaling profit booking after a strong pullback of more than 3500 points in just five sessions . The index started the session on a positive note and formed an intraday high of 35643 in the morning trade . However, profit booking at higher levels saw the index gave up its gains and closed the session around 35000 levels .

• Index in today session is opening gap up amid positive global cues and decline in crude oil prices . Going ahead, a couple of sessions of breather can not be ruled out after the recent strong up move . We believe it should not be seen as negative instead any dips towards the last Thursday gap up area around 34000 levels should be used as an incremental buying opportunity in quality banking stocks for next leg of up move towards 36600 levels in the coming weeks being the 61 . 8 % retracement of the previous major decline (39424 - 32155 )

• The index has major support around 32500 levels being the confluence of the following :

• (a) 80 % retracement of the previous major rally of April 2021 -October 2021 (30405 -41829 ) placed at 32600

• ( b ) previous major breakout area of February 2021 is also placed around 32500 levels

• Among the oscillators the weekly stochastic is seen rebounding from the oversold territory and has generated a buy signal moving above its three periods average thus validates overall positive bias in the index In the coming session, index is likely to open gap up amid strong global cues . We expect the index to trade with positive bias while maintaining higher high -low . Hence after a gap up opening use intraday dips towards 35210 -35280 for creating long position for target of 35540 , maintain a stop loss at 35090

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Asian markets were holding their nerve on Monday - Nirmal Bang