The benchmark index tumbled over 370 points at the opening bell - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (57973) / Nifty (17313)

The weakness in the US bourses over the weekend has shown substantial repercussions on the Indian equity market. The benchmark index tumbled over 370 points at the opening bell, setting a bleak start to the truncated week. Though the buying was quite relevant at the lower levels, that gradually pulled the indices upwards throughout the day, assuring the undertone remained bullish. The initial loss pared with a modest recovery, wherein the benchmark index concluded the day a tad above the 17300 level with a cut of 1.40 percent.

The global weakness has embarked on some selling in our equity space, but the bulls of D-street were resilient to let go of the opportunity and firmly bought the dips. Technically, the positive structure has been shaken a bit as the technical swing support of 17350 got breached decisively. At the current juncture, the 21 DEMA and the recent unfilled gap around 17380-17520 are expected to act as an immediate hurdle for the index in the comparable period. While on the downside, 17150- 17200 is expected to cushion any sort of fall, followed by the sacrosanct support of the unfilled gap around the psychological mark of 17000.

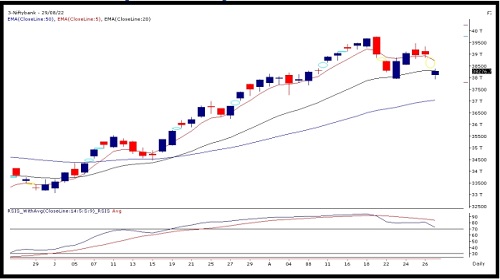

Nifty Bank Outlook (38277)

The global woes struck once again after Fed Chairman’s speech on Friday. This obviously had an adverse effect on markets across the globe. In line with this, the banking index opened with huge downside gap in tandem with our benchmark. Fortunately, after the initial hiccup, there was no major weakness seen in banking conglomerates. In fact, we witnessed some attempt of recovery which eventually restricted the price movement in a tight range. Eventually, the BANKNIFTY ended the session with 1.76% cut

We did not witness any follow through selling yesterday due to which the crucial psychological level of 38000 remains unbroken on a closing basis. However, we could see it placing tad below the ‘20-EMA’ level. In the coming session, we expect 38400-38600 to act as a resistance zone and on the flipside, 38000-37700 are the levels to watch out for. Although there was no further selling witnessed yesterday, one should avoid being complacent. We may see BANKNIFTY struggling at higher levels. Hence, it’s advisable to stay light and let this difficult time pass before taking any aggressive bets.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

More Indians investing in stocks, household savings need to be protected: FM Nirmala Sitharaman

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One