The Nifty small cap index clocked a fresh 52 weeks high after resolving out of past two months consolidation - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE (Nifty): 14634

Technical Outlook

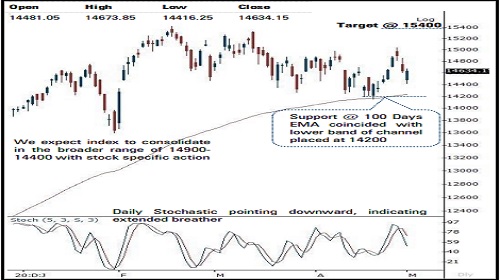

* Despite gap down opening (14631-14481) index managed to hold last week’s low (14200) as buying demand emerged from 61.8% retracement of last up move (14151-15044) that helped index to recover intraday losses (Nifty recovered > 250 points from day’s low 14416). As a result, daily price action formed a bull candle carrying lower high-low, highlighting buying demand at elevated support base. In the process, small cap index clocked a fresh 52 weeks high, highlighting broader market outperformance

* Going ahead, we expect index to eventually head towards all time high of 15400 in the month of May-21. We believe, the ongoing consolidation (14900-14400) amid positive bias would make market healthy and pave the way towards 15400. In the proses, stock specific action would prevail as we expect broader markets to outperform amid progression of Q4FY21 result season

* Key point to highlight is that, the recent up move (~900 points) is larger in magnitude compared to early March rally of 868 points. The elongated of up move signifies rejuvenation of upward momentum that augurs well for next leg of up move. Going forward, we expect corrections to be shallower in nature leading to a higher bottom formation

* The Nifty small cap index clocked a fresh 52 weeks high after resolving out of past two months consolidation, highlighting inherent strength. We expect, broader market indices to endure their relative outperformance wherein small cap would witness catch up activity as Nifty midcap index is hovering at its all-time high whereas small cap index is still 11% away from its life highs

* Structurally, we believe index has formed a higher base at key support threshold of 14200 which we do not expect to breach. Hence dips should be capitalised on as buying opportunity as level of 14200 is confluence of a) Lower band of falling channel at 14200 b) 100 days EMA at 14200 c)Last week’s panic low at 14151 In the coming session, follow through strength above Monday’s high (14674) would lead to extension of ongoing pullback. Hence, use intraday dip towards 14630-14655 to create long for target of 14744.

NSE Nifty Daily Candlestick Chart

Nifty Bank: 32465

Technical Outlook

* The daily price action formed a bullish hammer like candle as despite Monday’s gap down opening the index witnessed buying demand around 61.8% retracement of previous week up move (30451-34298) and recouped its entire decline. A follow through up move above Monday’s high ( 32566) will signal resumption of the up move

* Going ahead, after a up move of more than 3800 points, the index likely to consolidate in the 31500-34000 range. Therefore dips should be capitalised as buying opportunity, as w e expect index to head towards 34900 levels in the coming month being the 61.8% retracement of the entire decline (37708-30405).

* Key point to highlight i s that, the recent up move (3880 points) is larger in magnitude compared to late February up move of 2256 points. The elongation of up move signifies rejuvenation of upward momentum that augurs well for next leg of up move. Therefore, the current temporary cool off should not be seen as negative instead it should be capitalised to accumulate quality banking stocks

* The index maintained the rhythm of not correcting more than 20 % as witnessed since March 2020 . In the current scenario it rebounded after correcting 19 % from the all-time high (37708). Hence it provides favourable risk-reward setup for the next leg of up move

* The index has immediate support at 32000-31500 levels being the confluence of the previous week low and the 61.8% retracement of the current up move (30405-34287). While the major support is placed in the range of 30500-30000 levels

* In the coming session, the index is expected to open on a flat note amid mixed global cues. We expect the index to trade with positive bias while sustaining above 32000 levels. Hence, use dips towards 32450-32510 for creating long position for the target of 32740 , maintain a stoploss of 32340

Nifty Bank Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Index is likely to open on a flat note today and is likely to remain range bound during the ...