The Nifty settled the Monday`s session at 14239 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE (Nifty): 14239

Technical Outlook

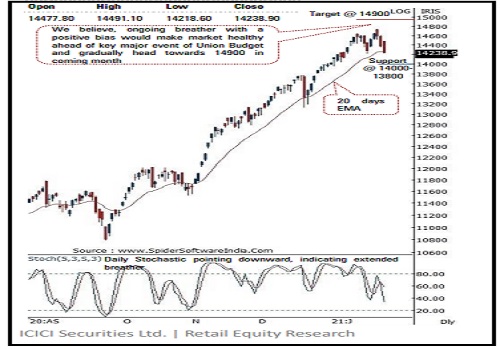

* Equity benchmarks started the truncated week on a subdued note as the index extended breather over third consecutive session. The Nifty settled the Monday's session at 14239, down 133 points or 0.9%. Market breadth remained in favour of declines with A/D ratio of 1:2.7. Sectorally, pharma and metal relatively outperformed while IT and auto took a breather.

* The daily price action formed a bear candle while maintaining a lower high-low formation, indicating extended breather as intraday pullbacks were short lived

* We believe the prolonged breather from here on would make market healthy ahead of key major event of Union Budget coincided with January series derivative expiry session, and eventually help index to form strong higher base formation in the vicinity of psychological mark of 14000, as we do not expect index to breach the strong support zone of 14000-13800. Meanwhile, stock specific activity would continue amid elevated volatility as we proceed the Q3FY21 earning season. Hence, any dip from here on should not be construed as negative instead it should be capitalized as incremental buying opportunity as we expect the Nifty to head towards 14900 in coming month, as it is confluence of:

* a) 138.2% extension of May-September rally (8806-11794), projected from September low of 10790, placed at 14919

* b) long term resistance trend line, drawn adjoining November 2010 March 2015 highs of 6334-9119, placed around 15000

* Key point to highlight is that, the Nifty midcap and small cap indices are undergoing slower pace of retracement as over past two weeks both indices have merely retraced 38% of preceding three weeks rally, indicating healthy consolidation, which has helped weekly stochastic oscillator to cool off the overbought condition (currently placed around 71). Thus, we expect broader market to form a higher base by regaining upward momentum and eventually outperform the benchmark. The Nifty midcap index has surged to new life-time highs, whereas small cap index is still ~30% away from all time high. Thus, we expect small caps to witness catch up activity

* Structurally, the Nifty has strong support base in the range of 14000- 13800 as it is confluence of 61.8% retracement of current up move (13131-14754) at 13751 coincided with January low of 13954

* In the coming session, Nifty future is likely to open on a negative note tracking weak global cues. We expect index to extend the breather amid stock specific action. Hence, use intraday pullback towards 14230-14255 in Nifty January future for creating short position for target of 14142

NSE Nifty Daily Candlestick Chart

Bank Nifty: 31198

Technical Outlook

* The Bank Nifty traded in a range with high volatility and closed on a flat note on Monday . The index opened on a positive note but failed to sustain at higher levels and gave up its intraday gains . Market breadth was down with eight out of the 12 index constituents closed in the red . Nifty bank index ended the session at 31198 , up marginally by 31 points or 0 . 1 %

* The daily price action formed a small bear candle which mostly remained contained inside previous session high –low range signalling consolidation after last two sessions sharp profit booking, from vicinity of our target area of 33000 .

* Going forward, we expect consolidation in the broad range of 30800 -33000 . We believe the current leg of profit booking followed by higher base formation, after a sharp run up would make market healthier ahead of key major event of Union Budget . Therefore, investors should not construct the current profit booking as negative, rather utilize the same as an incremental buying opportunity to accumulate quality banking stocks

* The index has immediate support at 30800 -31000 levels, sustaining above which will lead to a pullback in the coming week . Failure to do so will signal extended correction towards 30200 levels . The immediate support of 30800 -31000 is based on the confluence of the following technical observations : a) 50 % retracement of the current up move (28976 -32842 ) placed at 30910 levels b)The rising 34 days EMA which has acted as a strong support since October is also placed around 30950 levels c)The upper band of the recent range breakout is also placed around 31072 levels

* In the coming session, the index is likely to open on a negative note on the back of soft Asian cues . Volatility is likely to remain high ahead of the monthly derivative expiry . We expect index to extend the breather amid stock specific action . Hence, use intraday pullback towards 31270 -31330 in Nifty January future for creating short position for target of 31060 , maintain a stoploss of 31430 Among the oscillators, the daily stochastic has approached oversold territory with a reading of 16 , hence supportive effort at lower levels is likely in the coming sessions

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Vedanta-Iron and Steel signs MoU with IIT-B for R&D to develop technology for 'Green Steel' ...

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct