The Nifty index settled at 18,812.5 levels - Religare Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty Outlook

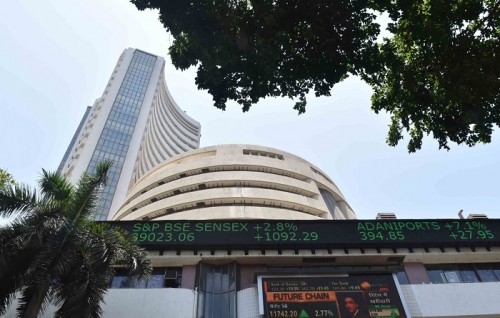

Markets managed to end marginally higher amid volatility on the weekly expiry day. Firm global cues triggered a gap-up start in Nifty however profit taking at the higher levels trimmed the gains as the day progressed. Finally, the Nifty index settled at 18,812.5 levels. Among the sectoral pack, IT, metal and realty remained in flavour while energy, auto and FMCG were slightly on the back foot. Amid all, the broader indices outperformed the benchmark and posted decent gains.

We may see a bit of consolidation after the recent surge however upbeat global cues would keep the tone positive. Besides, improvement in the broader market participation is added relief. Participants should continue with a positive bias and utilise pause or dip as a buying opportunity. At the same time, one should not go overboard and stick largely with the index majors and quality midcaps.

News

* Coal India produced 60.7 MT of coal for the month of November, up by 12.8% over last year. The supply of coal by CIL to power plants was at 380.7 MT during April-November period, registering a growth of 11.6%.

* GST collection came in Rs 145,867 Cr up by 11% for the month of November. Overall, there is substantial spending by the consumers and the major factors for increase in collections are festive and wedding season as well as increase in sales for real estate and vehicle markets.

* L&T announced it has successfully closed a 3-year USD 107 Mn sustainability-linked loan from Sumitomo Mitsui Banking Corporation. SMBC appointed as the sole Sustainability Coordinator and Lender. This sustainability linked loan underscores L&T’s continued commitment to its ESG goals.

Derivative Ideas

ITC shed 0.13% and closed at 339.55 on 1st Dec. The scrip after opening flat witnessed stiff resistance at the higher levels. ITC December futures added around 6% Open Interest with a decline in price suggesting formation of fresh shorts. With substantial Call selling seen at 350 strike, we expect ITC to consolidate with a negative bias and trade in the range of 350-330 in the short term, thus suggesting selling CE as per the given levels.

Strategy:- SELL ITC 29 DEC 350 CE @ 5-5.5, STOP LOSS 7.5, TARGET 1.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Nifty has an immediate resistance placed at 15900 and on a decisive close above expect a ris...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">