The Nifty continued to remain positive in a highly volatile day - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

INR Futures

* After a few days of appreciation, the rupee witnessed some selling from its monthly highs and closed near 72.42 levels. Weakness was seen in most EM currencies

* The dollar index on Tuesday rallied to a two-week high ahead of Jerome Powell’s testimony. The index reclaimed 92 levels as weakness in stocks on Tuesday increased the liquidity demand for the dollar

Global Bonds

* The Nifty continued to remain positive in a highly volatile day and closed with a gain of near 0.50%. The up move was led by banking and cement stocks while selling pressure was seen in metals and FMCG stocks

* On Tuesday, the Bank Nifty remained sluggish in the first half but witnessed gradual buying in the later part. The Bank Nifty managed to close above its major Call base of 34000 with the help of select private sector heavyweights

FII & FPI Activities

* Foreign institutional investors (FII) remained net buyer to the tune of | 656 crore on March 22. They bought worth | 277 crore in the equity market and bought worth | 379 crore in the debt market

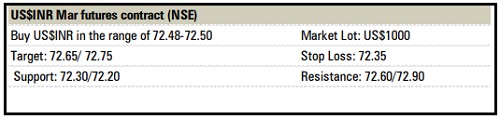

US$INR futures on NSE

* Due to a sudden rise in the Dollar index the US$INR pair moved higher as most EM currencies depreciated. However, depreciation could be limited and the rupee is likely to trade in a range due to aggressive Call writing in OTM strikes and weakness in crude oil prices

* The dollar-rupee March contract on the NSE was at | 72.54 in the last session. The open interest increased by almost 0.8% for the March series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">