The Nifty Bank index continued with its positive momentum - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE (Nifty):15116

Technical Outlook

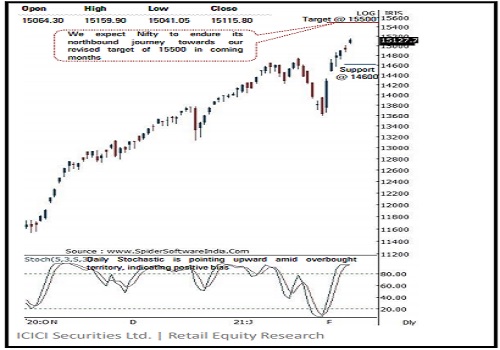

* Equity benchmarks started the week on a buoyant note tracking firm global cues. The Nifty clocked a fresh all-time high of 15160 and eventually ended the session at 15116, up 192 points or 1.3%. Market breadth remained robust with A/D ratio of 1.5:1. Sectorally, auto, IT, metal outshone while, FMCG and PSU banks took a breather.

* The Nifty opened the week with a positive gap (14924-15041) and sustained above the same throughout the sessions, highlighting market resilience. As a result, index formed a bull candle carrying higher high-low over sixth consecutive session, indicating continuance of strong momentum, in tandem with global peers.

* Going ahead, we reiterate our positive stance on the index and expect the Nifty to head towards 15500 in coming month, as it is 161.8% external retracement of past two week’s fall (14754-13596), at 15466. The rotating sectoral leadership backed by strengthening of market breadth signifies inherent market strength. We believe, revived traction in banking, consumption, infra, IT and pharma would drive index higher

* Key point to highlight is that the Nifty has rallied more than 1560 points over past six sessions, which hauled the daily stochastic oscillator in overbought territory (at 96), indicating a couple of days shallow retracement cannot be ruled out.

* However, for a temporary breather to materialise index need to decisively close below previous sessions' low (15015) else there will be continuance of positive bias amid stock specific action amid ongoing Q3FY21 result season. Thus, capitalising on dips to go long in quality large cap and midcap would be the prudent strategy to ride next leg of rally

* Broader markets relatively outperformed the benchmark, as the Nifty midcap, small cap gained over 1.5%, each. The follow through strength post faster pace of retracement augurs well for further acceleration of upward momentum. The Nifty Midcap index has recorded a fresh all-time high, whereas small cap index is still ~20% away from all-time high. Therefore, we expect small caps to witness catch up activity within broader market space

* Structurally, formation of higher peak, trough on the larger degree chart signifies strong up trend is intact, which makes us confident to revise support base upward at 14600, as it is confluence of 38.2% retracement of current up move (13597-15060), placed at 14562 coincided with earlier consolidation breakout area around 14650

* In the coming session, Nifty future is likely to open on a positive note tracking firm global cues. We expect index to hold the Monday’s positive gap (14924-15041) and trade with a positive bias. Hence, use intraday dips towards 15090-15112 to create long position for the target of 15197.

NSE Nifty Daily Candlestick Chart

Bank Nifty: 35983

Technical Outlook

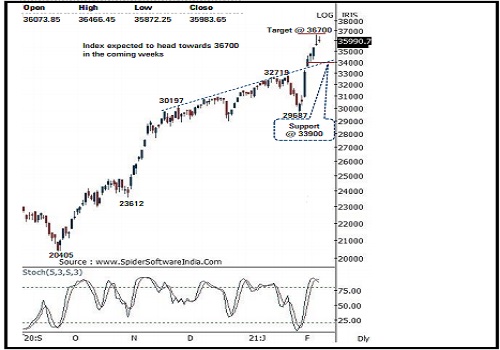

* The Nifty Bank index continued with its positive momentum and closed higher for the eight consecutive session to close up by 0.9% on Monday. The up move was lead by the private banking stocks while the PSU banking stock witnessed profit booking after last weeks strong up move and closed lower by 1 % . The Bank Nifty closed at 35983 up by 329 points or 0 . 9 %

* The daily price action formed a high wave candle while maintaining higher low for the seventh consecutive session signalling strength and continuation of the up trend .

* Going ahead, we expect the index to maintain its overall positive stance and head towards 36700 in coming weeks while elevated support is now being placed at 33900 levels .

* However, after a rally of 6900 points in just eight trading sessions, which has led daily stochastic to overbought trajectory with reading of 88 . Hence intermediate profit booking at higher levels cannot be ruled out and one should adopt buy on decline strategy as the overall structure remain firmly positive for up move towards 36700 levels as it is the 123 . 6 % external retracement of entire CY20 decline (32613 - 16116 )

* We are confident in revising support upwards at 33900 mark which is the confluence of the following technical observations : a) 38 . 2 % retracement of the current up move 29687 to 36615 is placed around 33968 levels b) Value of a bullish gap post Budget day at 33583 levels c) The value of the rising trendline joining recent high since November 2020 is also placed around 33900 levels

* In the coming session, we expect index is likely to open on a positive note tracking firm global cues. We expect index to trade with a positive bias while maintaining higher low formation . Hence , after a positive opening we recommend to utilize intra day dips towards 35870 -35930 create fresh long positions in Bank Nifty February Futures to for target of 36140 meanwhile stop loss is placed at 35770

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Daily Market Commentary 12th January 2022 By Mr. Siddhartha Khemka, Motilal Oswal