The Gold prices are expected to correct further towards 50,400 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

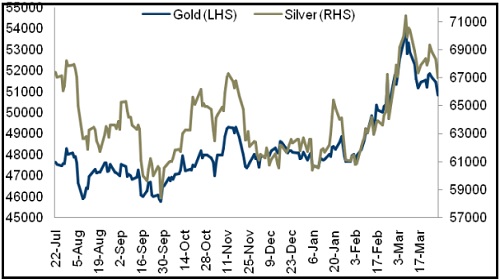

Bullion Outlook

• Comex gold prices declined 1.19% on Tuesday amid optimistic sentiments in global markets and on better than expected macroeconomic data from the US. The US consumer confidence index increased to 107.2 levels in March 2022 compared to 105.70 levels in the preceding month, highest level since March 2021 amid growing labour market optimism

• However, a sharp decline in US dollar index and 10 year US bond yields restricted further downsides in bullion prices

• The Gold prices are expected to correct further towards | 50,400 due to slightly easing geopolitical tensions between Ukraine and Russia. Moreover, expectations of improved GDP data from the US will continue to weigh on bullion prices. Silver prices are expected to take cues from gold prices and likely to drag down towards 66,000 for the day. Additionally, investors will keep an eye on ADP Non farm payroll data from the US

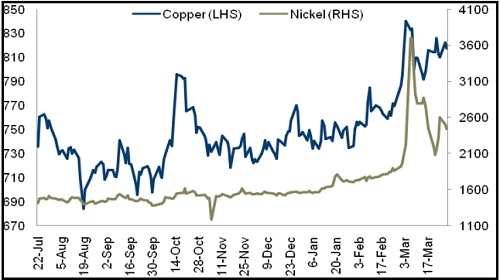

Base Metal Outlook

• LME Copper and other industrial metal prices tumbled on Tuesday due to concerns over a surging Covid-19 cases in China weighed on the Industrial metal demand.

• At the same time, LME registered warehouse stockpiles of copper rebounded to 81,500 tonnes from 79,500 tonnes over the last week added downward pressure to the copper prices

• However, US dollar index retreated by 0.69% on Tuesday, making metals cheaper for holder of other currencies

• MCX Copper prices are expected to trade with a negative bias due to weaker demand from China. However, expectations of improved macro economic data from the US may prevent further downsides in Industrial metal prices. MCX Copper price is facing strong resistance at | 825 levels. As long as it sustains below this level, it is likely to retest | 800 levels in the coming days..

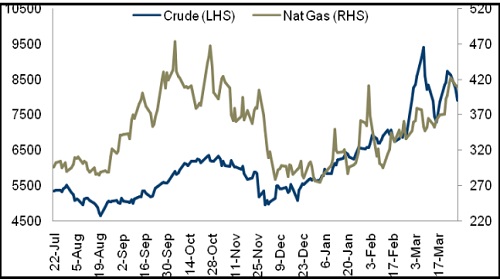

Energy Outlook

• Nymex crude oil prices slipped 2.50% amid optimism around peace talks between Russia and Ukraine to end their weeks long conflict

• Further, crude oil prices were pressurised by concerns over Chinese fuel demand after new lockdowns and travel restrictions implemented in China to curb the spread of Covid-19 cases

• However, Opec is expected to stick to its plan for a modest output increase in May despite higher oil prices and calls from the US for more supply

• MCX crude oil prices are likely to trade in the consolidation range of | 7,500 to | 8,200 for the day due to concerns over China’s fuel demand However, anticipations of lower oil supply from OPEC countries are expected to support the oil prices on lower side.

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">