The Bank Nifty has clearly outshined the benchmark index in last two trading sessions - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

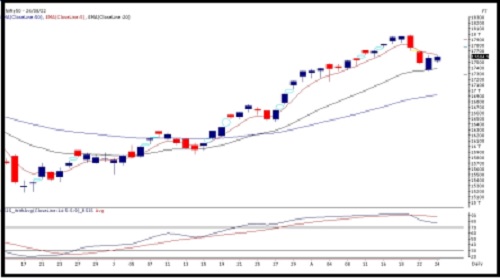

Sensex (59085) / Nifty (17605)

Our markets started the session on a soft note by shrugging off unfavourable cues from the global bourses. During the remaining part of the session, both counterparties made several attempts to show their dominance; but eventually, the bulls turned out victorious as we witnessed a good traction in the last hour to reclaim the 17600 mark on a closing basis.

In the midst of mild tug of war yesterday, our markets managed to close in the green by a small margin. If we observe meticulously, the Nifty kept oscillating in merely 70-80 points throughout the session, which is a sign of consolidation. The real action was seen outside the index as lot of individual stocks gave excellent moves in the latter half. For the coming session, we expect this consolidation to continue for key indices. As far as levels are concerned, 17650 – 17710 is to be seen as immediate resistance zone and momentum traders should ideally look to lighten up longs around it from an expiry perspective. On the flipside, 17525 – 17450 remains to be an intraday supports.

Globally, things have once again become slightly turbulent and hence, it’s advisable not to get complacent here. Rather, following one step at a time is the appropriate strategy.

Nifty Bank Outlook (39038)

Post Tuesday recovery, the banking index opened slightly lower but soon smart buying emerged right from the word go reclaim 38900. In the midst, we did see some dip which got bought into to settle the day with yet another day of strong close with the gains of 0.88% tad above 39000.

The BankNifty has clearly outshined the benchmark index in last two trading sessions and has managed to fill the bearish gap formed around 38800. In our previous commentary, we had mentioned the weakness seen was just a price wise correction and the overall picture still appears optimistic. With yesterday follow-up move the base has now shifted higher to 38500-38600 zone. On the higher side, the immediate resistance is seen around 39400-39500 zone. For the coming session, we expect continuation of northward move and hence would advocate utilizing intraday dips to add fresh longs.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One

More News

Opening Bell : Markets likely to extend previous session`s gains with gap-up opening