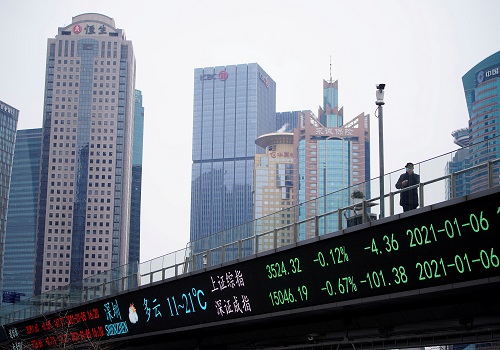

Tech sells off as Nasdaq plunges more than 2%

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The Nasdaq tumbled more than 2% on Tuesday as steep declines in megacap growth stocks pushed Wall Street below record trading levels, with investors seeking shelter in more defensive parts of the market.

Highly valued technology-related companies including Microsoft Corp, Alphabet Inc, Apple Inc, Amazon.com Inc and Facebook Inc fell between 2.2% and 4.2%. The Philadelphia Semiconductor Index dropped over 2.3%.

Comments by Treasury Secretary Janet Yellen on the potential need for rising interest rate further exacerbated the tech selloff, as investors worry higher rates would weigh on valuations of growth companies.

"It may be that interest rates will have to rise somewhat to make sure that our economy doesn't overheat, even though the additional spending is relatively small relative to the size of the economy," she said in taped comments at a virtual event by The Atlantic on Tuesday.

Seven out of the 11 major S&P 500 sectors were down, with technology, communication services and consumer discretionary falling more than 1.7% each.

The defensive financials, materials and energy sectors managed to extend their gains from Monday, rising sightly in early afternoon trading.

"When you're at all-time highs and the market pulls back, the ones that tend to lead to the downside are often the high-beta stocks such as technology," said Randy Frederick, vice president of trading and derivatives for Charles Schwab in Austin, Texas.

"When we have pauses or pullbacks people tend to move out of growth stocks into more defensive names."

Fiscal stimulus, rapid vaccinations and the Federal Reserve's accommodative stance have spurred a strong rebound in the U.S. economy and pushed Wall Street to record highs this year. The so-called "pandemic winners," however, have recently started to fall out of favor.

By 2:05 p.m. ET (1805 GMT), the Dow Jones Industrial Average fell 72.32 points, or 0.21%, to 34,040.91, the S&P 500 lost 44.02 points, or 1.05%, to 4,148.64 and the Nasdaq Composite dropped 343.71 points, or 2.47%, to 13,551.41.

The largest percentage gainer on the S&P 500 was Gartner, which rose 12.7% after delivering better-than-expected first-quarter earnings.

Among other stocks, CVS Health Corp gained 4.1% after reporting a first-quarter profit above analysts' estimates and raising its 2021 forecast.

First-quarter earnings have been largely upbeat. Average profits at S&P 500 companies are expected to have risen 47.7% in the quarter, compared with forecasts of a 24% growth at the start of April, according to IBES data from Refinitiv.

Investors are also awaiting data through the week, including the Labor Department's monthly non-farm payrolls due on Friday. The report is expected to show a rise in job additions in April.

Declining issues outnumbered advancers for a 2.37-to-1 ratio on the NYSE and for a 4.03-to-1 ratio on the Nasdaq. The S&P index recorded 69 new 52-week highs and no new low, while the Nasdaq recorded 66 new highs and 87 new lows.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">