Tax for cooperative societies reduced in Union Budget

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

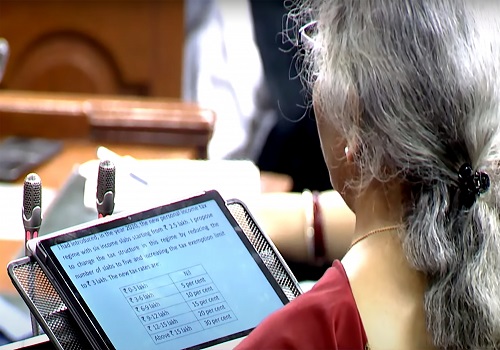

In order to provide a level playing field between the co-operative societies and companies, the government proposes to reduce the Alternate Minimum Tax rate for co-operative societies to 15 per cent from the current 18.5 per cent, Finance Minister Nirmala Sitharaman announced while presenting the Union Budget 2022-23 in the Parliament on Tuesday.

She added that the government also proposes to reduce the surcharge on co-operative societies to 7 per cent from 12 per cent at present for those having total income of more than Rs 1 crore and up to Rs 10 crore. She said that this would help enhance the income of cooperative societies and its members, who are mostly from rural and farming communities.

Stating that startups have emerged as drivers of growth for the economy, the minister, in order to assist them during the Covid-19 pandemic, proposed to extend the period for incorporation of the eligible startup by one more year up to March 31, 2023 to provide them tax incentive for three consecutive years out of 10 years from incorporation. This incentive was earlier available to eligible startups established before March 31, 2022.

Sitharaman said that to establish a globally competitive business environment, a concessional tax regime of 15 per cent was introduced by the government for certain newly-incorporated domestic manufacturing companies. The government proposes to extend the last date for commencement of manufacturing or production under Section 115BAB by one year to March 31, 2024 from March 31, 2023.

Noting that as a business promotion strategy, there is a tendency on businesses to pass on benefits to their agents, which are taxable in the hands of the agents, Sitharaman said that in order to track such transactions, the Government proposes to provide for tax deduction by the person giving benefits, if the aggregate value of such benefits exceeds Rs 20,000 during the financial year.

Stating that the ‘Health and Education Cess' is imposed as an additional surcharge on the taxpayer for funding specific government welfare programs, the minister, to reiterate the legislative intent, proposed to clarify that any surcharge or cess on income and profits is not allowable as business expenditure.

She said that income-tax also includes surcharge and observed that it is "not an allowable expenditure for computation of business income".

Sitharaman announced that the government proposes to provide that no set off of any loss shall be allowed against undisclosed income detected during search and survey operations. She pointed out that It has been observed that in many cases where undisclosed income or suppression of sales among others is detected, payment of tax is avoided by setting off, of losses. This proposal would bring certainty and would increase deterrence among tax evaders, stated the minister.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">