Tata Mutual Fund - Through the Lens: Fixed Income Outlook - March 2021

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

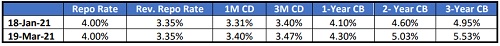

Rate Movements

Movement of Short-Term Rates

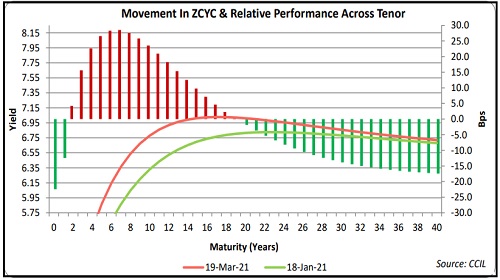

Movement of Long-Term Rates

Yields of instruments in the shortest end of the curve (0-3 months) rose by 7-10 bps, while yields of short term corporate bonds rose by ~20 bps in the 1-year segment, while rising by 45-55 bps in the 2-3 year segment.

Yields of corporate bonds in the 5-10 year segment rose by 45-60 bps in the 5-10 year segment. G-Sec Yields in the 5-10-year segment rose by ~25-45 bps.

Interest Rate Yield Curve Movement

Average movement in yield curve is 21.5 bps upwards. While yields across tenors have inched up, the short term curve has underperformed (yields have moved up more than long term curve).

Outlook on Rate Going Ahead

* No more rate cuts by RBI are expected, indicating an end of easing cycle

* RBI’s stance to remain accommodative for CY2021

* RBI to continue with OMO purchases of G-Sec and SDLs

* Yield curve to inch-up generally and witness bear steepening (longer term yields rising faster than shorter term yields)

* RBI to gradually return to a normal Monetary Policy. RBI is expected to act to remove abundant surplus liquidity, however, liquidity is likely to remain positive.

* RBI is likely to conduct reverse rate repos, hike CRR and take a neutral policy stance through FY22

Macro Update

Consumer Price Inflation (CPI)

* Food inflation inched up by 4.25% YoY in Feb 2021 against 2.67% YoY in Jan 2021. On a sequential basis, food momentum contracted by 0.44% in Feb 2021 vs a sharp contraction of 2.11% in Jan 2021. The sequential correction in food prices was primarily led by Eggs (-3.54%), Vegetables (- 3.50%) and Meat & Fish (-1.01%).

* Consolidated fuel inflation rose by 6.96% YoY in Feb-21 from 5.67% in Jan-21. On sequential basis, it increased by 2.03% in Feb-21 from 1.53% in Jan-21 led by sharp rise in petrol and diesel prices.

* Core inflation (ex. food, and fuel) hardened to 5.59% YoY in Feb-21 from 5.33% YoY in Jan-21. The rise in core inflation was predominantly led by spike in Transport & Communication cost amidst rise in petrol and diesel prices followed by increase in prices of Household goods & services.

* Outlook: We expect CPI inflation to remain above RBI mid-point target of 4%, but well within the upper tolerance level of 6%. While Food inflation is expected to continue softening, high fuel prices do lend an upward pressure on whole CPI inflation trajectory. Also, with demand side improving, we expect core inflation to also remain in high trajectory (5.25-5.75 band).

* On the policy front, the current readings would not lead to any change in Monetary Policy. However, sharp movement in crude prices is expected to keep monetary policy under pressure. We expect RBI to remain accommodative in near term.

Index of Industrial Production (IIP)

* Industrial Production contracted by 1.6% in January vs. an upwardly revised growth of 1.6% YoY in December. The contraction was largely led by a decline in manufacturing activity and mining activity, which contracted for the fourth consecutive month.

* Sequentially, IIP contracted by 1.05% In Jan 2021 vs expansion of 8.3% in Dec 2020.

* Manufacturing output contracted by 2.11% in Jan 2021 vs growth of 2.1% in Dec 2020.

* On use-based side, production of both consumer durables and non-durables contracted in January suggesting demand eased both in urban and rural level.

* Improvement in manufacturing activity as indicated by high frequency data like PMI readings could provide fillip to IIP in coming times. Also, with broad based demand improving, we expect IIP to come back into green zone.

Trade

* India’s trade deficit narrowed to $12.9 bn in Feb 2021 vs $14.5 bn deficit in Jan 2021. This was led by fall on non-oil non-gold imports.

* As per the preliminary trade data, imports grew by 7% YoY in Feb-2021 vs 2% growth in Jan 2021. Non-oil Non-gold imports were higher by 7.4%. this was 3rd consecutive increase in the category.

* Exports contracted by 0.3% YoY in Feb 2021 against a growth of 6.2% in Jan 2021. This was mainly on account of oil exports, which were lower by 27.1%, fifth consecutive month of decline.

* For FY-21, Current account surplus may be 1.1%-1.2% of GDP, and a deficit may be 1.2%-1.3% of GDP in FY 22, mainly on account of improving demand prospects leading to higher growth in imports.

Above views are of the author and not of the website kindly read disclaimer