Stocks shrug off Wall St rally as focus shifts to China worries

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

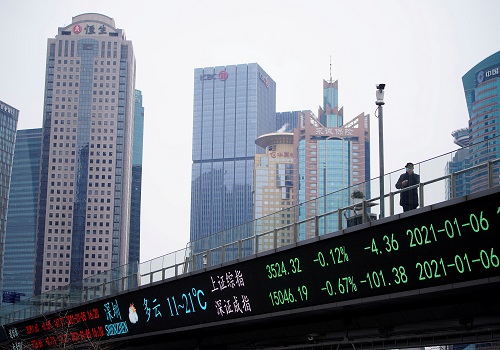

Asian stocks were mixed on Friday as fresh concerns about Chinese growth trumped any fillip regional markets received from brisk Wall Street earnings and some tempering of more aggressive expectations about U.S. interest rate hikes.

MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.31%, swinging into the red. Japan's Nikkei share average fell 0.26%, also erasing earlier gains.

Pulling broader sentiment down were Chinese markets, with Hong Kong's Hang Seng index and the Shanghai composite index falling as much as 2.3% and 0.72% respectively. The Seoul index and Australia's index were up 0.40% and 0.88%, respectively.

Futures markets pointed to a brisk European session with EUROSTOXX 50 futures up 0.38% and FTSE futures climbing 0.25%.

The yen firmed against the dollar at 133.44, heading for its best month in two years as a fall in U.S. Treasury yields hit the greenback.

Analysts say the overnight Wall Street rally could point to a disconnect between the dire reality consumers face and markets trying to leap forward and price in a Federal Reserve rate cut.

"Enjoy the rally while it's there, but look carefully at the Fed messaging which depends on the course of inflation, look at the gas crisis in Europe where markets might panic, look at China still stuck in the mud because of their COVID policy," said Stephen Innes of SPI Asset Management. "We could go into deeper downswing because CPI data is slipping globally."

Overnight, the Dow Jones Industrial Average rose 1.03%, the S&P 500 gained 1.21% and the Nasdaq Composite added 1.08%.

Economists are debating whether the world's biggest economy is already in or on the verge of a recession, as it battles its highest inflation in four decades and gross domestic product shrinks - at a 0.9% annualized rate last quarter, after a 1.6% contraction in the quarter before that.

The Federal Reserve delivered another aggressive interest rate hike of 75 basis points this week, its third this year.

In Asia, investors focused on headlines that showed Beijing omitting reference to its full-year GDP growth target after a high-level Communist Party meeting, instead focusing on achieving the best possible results for the economy this year.

Equities, however, rallied this week as comments by Fed Chair Jerome Powell led to speculation that rate hikes would begin to slow and eventually turn to rate cuts in 2023. Shares of Amazon and Apple shot up 12% and 3%, respectively, after hours as the tech giants reported better-than-expected earnings.

The yield on benchmark 10-year Treasury notes was at 2.6704% while the two-year note's yield, which typically moves in step with interest-rate expectations, was at 2.8399%.

"There's this see-saw at the moment with inflation and growth concerns," said Tom Nash, fixed income portfolio manager at UBS Asset Management in Sydney, with surprisingly soft U.S. growth figures putting the focus on the latter.

"When it's inflation concerns, yields are going up, when it's growth concerns yields are going down. What we're seeing at the moment is the market is putting less emphasis on inflation and more on growth."

Brent crude futures turned negative, dropping 0.14% to $106.99 a barrel after hitting $108 in previous trade, and U.S. West Texas Intermediate crude (WTI) was at $96.64.

Gold rose 0.38% to $1,762 an ounce, pressured by a strong dollar and Treasury yields.

To read Reuters Markets and Finance news, click on the state of play of Asian stock markets please click on:

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">