Sell US$INR April Futures around 76.10-76.15 for target of 75.30 with Stop loss of 76.60 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

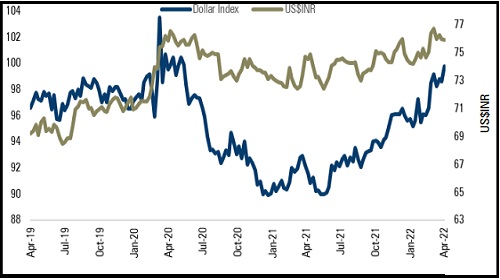

Rupee likely to appreciate amid ease in crude oil prices

• The rupee depreciated marginally during the week amid strong dollar and muted domestic market. Meanwhile, easing of crude oil prices prevented a further decline in the rupee

• The dollar rallied amid a surge in US treasury yields and upbeat economic data from the US. Further, the dollar gained strength as minutes showed that officials could raise interest rates by 50 bps at their meeting early next month and begin reducing their asset holdings much faster than they did last decade

• We expect the rupee to appreciate in the coming week amid softening of crude oil prices. Also, RBI hinted at gradually moving away from its loose monetary policy to combat high inflation and leaving repo rate unchanged while introducing SDF at 3.75% to absorb excess liquidity from the system. Market participants will also keep an eye on CPI data, which is likely to show that inflation eased in March and remained under RBI’s comfort zone

EURINR expected to bounce back till 83.80

• The Euro depreciated significantly by 1.60% in the previous week amid strong dollar, disappointing economic data from eurozone and risk aversion in global markets. Market sentiments were hurt on fears that sanctions on Russia may add to inflationary pressure, hurting growth. Additionally, the Euro slipped on concerns about outcome of the French elections • The Euro is expected to take support near 1.08 level and bounce ahead of ECB’s monetary policy. The central bank is likely to keep its interest rate unchanged in the upcoming meeting but may provide signals on future monetary stance. Investors are anticipating that stubbornly high inflation may force the ECB to tighten their monetary policy more aggressively. However, expectation of disappointing economic data from the euro area and firm dollar may hurt the single currency. EURINR (April) is expected to trade in a range of 82.30-83.80

• The pound depreciated by 0.62% in the preceding week amid strong dollar and risk aversion in global markets. Further, the pound slipped on growing divergence between US Fed and BoE on how to tackle inflation. However, sharp downside was cushioned on better-than-expected economic data from Britain

• The pound is expected to take support near 1.30 and bounce back till 1.31, which is a strong resistance. A break above this level may open the doors for a further rise till 1.32. The pound may trade with a positive bias as UK CPI data is likely to show that inflation remained elevated and jobs data may reflect a strong labour market, making a case for BoE to further tighten its monetary policy

US$INR Strategy

Sell US$INR April Futures around 76.10-76.15 for target of 75.30 with Stop loss of 76.60

Rationale: We expect the rupee to appreciate in the coming week amid softening of crude oil prices and as the RBI hinted at gradually moving away from its loose monetary policy to combat high inflation. RBI left the repo rate unchanged while introducing SDF at 3.75% to absorb excess liquidity from the system. Additionally, market participants will keep an eye on CPI data, which is likely to show that inflation eased in March and remained under RBI’s comfort zone.

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">