Equity AUM rises 41% YoY in FY22; records highest ever net inflows in a year - Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Key observations

The Nifty ended FY22 with gains of 19% YoY, marking another year of strong returns despite the multitude of challenges (lockdowns announced due to the second COVID wave, rate hikes by the US Fed, withdrawal of excess global liquidity, Russia-Ukraine conflict, the relentless rise in commodity prices, disruption in supply chains, and weak rural demand). DII equity inflows in FY22 were the highest ever at USD26.8b v/s outflows of USD18.4b in FY21, while FIIs witnessed equity outflows of USD17.1b after five consecutive years of inflows. Defying the looming challenges, investors continue to invest in MFs with inflows and contributions in systematic investment plans (SIPs) reaching fresh highs of INR123.3b in Mar’22 (up 7.8% MoM and 34.3% YoY).

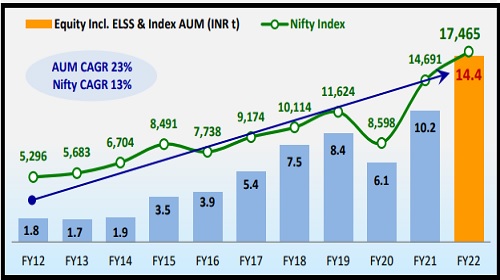

Equity AUM for domestic MFs (including ELSS and index funds) reached new highs of INR14.4t (+41% YoY) in FY22, led by a) a rise in market indices (Nifty: +19% YoY) and b) an increase in equity scheme sales (up 98% YoY to INR4,577b). Further, redemptions declined marginally by 2% YoY to INR2,589b. Consequently, net inflows came in at an all time high of INR1,988b in FY22, after recording outflows of INR347b in FY21. The MF industry’s total AUM increased 20% YoY (INR6.1t) to INR37.6t in FY22, led by a growth in equity funds (INR4,221b), other ETFs (INR1,354b), and balanced funds (INR1,163b). Notably, income funds declined INR1,282b YoY in FY22.

Some interesting facts

* The year saw a notable change in the sector and stock allocation of funds. The weight of domestic cyclicals increased 30bp to 58.9%, propelled by an increase in the weights of Capital Goods, Retail, and NBFCs, while Private Banks, Cement, Consumer Durables, and Automobiles moderated (refer to page 4 for detailed charts).

* The weight of Defensives declined marginally by 10bp to 31.8%, weighed down by Consumer, Healthcare, and Utilities. Global cyclicals’ weightage, too, fell 10bp to 9.4%. Technology saw a massive increase in weight to 13% (+150bp YoY) in FY22. The sector ranked second in sectoral allocation by MFs.

* Consumer slipped to the seventh place from the fourth spot a year ago, with a 110bp contraction in weight to 6.1%.

* PSU Banks improved its position to 9 from 11 a year ago, with the weight increasing 30bp to 3.4%.

* Cement’s position deteriorated to 14 from 10 a year ago, with the weightage declining 70bp to 2.5%.

Equity AUM rises 41% in FY22 to touch new highs

o Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

The short term trend of Nifty continues to be weak - HDFC Securities