Rupee jumps as dollar tumbles on bets of less hawkish Fed

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The Indian rupee strengthened on Thursday, taking heart from the dollar index's plunge overnight on growing views that softer U.S. economic data may prompt the Federal Reserve to slow the pace of its rate hikes.

Coming off a domestic market holiday on Wednesday, the rupee climbed 0.5% to 82.3125 per dollar by 0435 GMT, outperforming its Asian counterparts, but pulling back from it own high of 82.14 in early trade.

"The rupee has opened up but the rally may not sustain", said a foreign exchange trader at a bank.

It's a good level for importers to hedge, the trader said, adding that as the currency is expected to depreciate in the long term, oil firms and importers would likely step in to buy dollars at current levels.

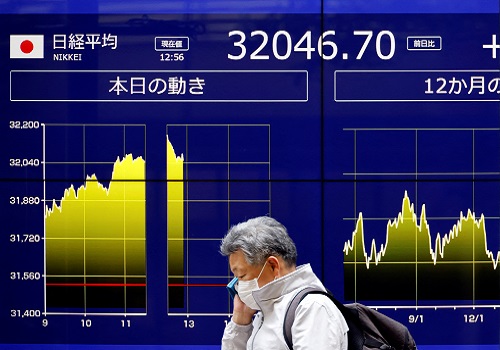

Global equities rallied as the dollar index fell below 110-levels for the first time in over a month and U.S. yields retreated after soft housing data raised bets that the Fed would hike rates in smaller increments from December.

The dollar's relentless rally over the past month had seen risk assets get dumped, with the rupee plunging from around 79.80 per dollar to even breaching 83.

A 75-basis point hike by the Fed at next week's meeting was fully priced in, but the odds of a similar-sized hike in December drop to near 1-in-3 from about 75% a week back.

Also bolstering views of global central banks softening their stance was the Bank of Canada increasing interest rates by a smaller-than-expected 50 bps and saying further hikes would be influenced by its assessment of how tighter policy was working to slow demand and ease inflation.

However, regional currencies were a mixed bag, weighed down by the Chinese yuan plunging 0.6%.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">