Rupee Gyrating Around Psychological Level Of 75 - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Gyrating Around Psychological Level Of 75 - HDFC Securities

Indian rupee expected to open slightly higher following rebound in risk assets after some respite from the volatility sparked by Russia’s invasion of Ukraine. The forward markets indicating USDINR could open 2-3 paise higher but as crude oil prices continue rolling, the momentum could again switch upward.

On Tuesday, spot USDINR declined 5 paise to 76.91 after touching all time high on Monday. Higher level profit booking and central bank’s swap has added pressure on pair. Technically, it is having resistance around 77.30 and support at 76.70.

Asian futures traded slightly higher on expectation of some moderation in the violence possibly after Ukraine is no longer insisting on NATO membership

Euro gained after European union and its continental counterparts rallied following a report that the European Union is considering issuing joint debt for energy and defense. Euro advanced as much as 1% in the wake of the report to rise to 1.0958 against the dollar, before paring gains, reached its lowest level since May 2020 on Monday.

President Joe Biden announced a U.S. ban on Russian oil imports, ratcheting up pressure on Moscow in retaliation for its invasion of Ukraine as the war in eastern Europe continues to worry investors.

Crude climbed but at a slower pace, as the market digested the US and UK move to ban imports of Russian fossil fuels to punish the nation for the war. West Texas Intermediate oil was around the highest since 2008 at close to $125 a barrel.

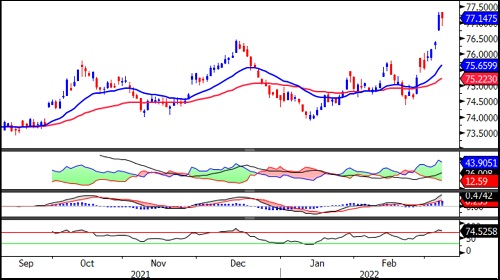

USDINR

Technical Observations:

USDINR March futures formed hammer candlestick pattern indicating continuation of upward momentum

The pair has been trading well above short term moving averages.

Relative Strength Index of 14 days period placed at 75 and heading north indicating continuation of bullish momentum.

MACD has bullish with histogram making bigger blocks indicating inherent strength in up trend.

Derivative price actions indicating short build up as price falls and open interest rises

USDINR March futures is having gap support in the area of 76.50 to 76.30 while recent top 77.30 remains near term resistance.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">