Rupee Depreciates As Crude Oil Surges - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Depreciates As Crude Oil Surges - HDFC Securities

Indian rupee came under-pressure as crude oil surges while domestic equities tumbles following foreign fund selling. The one month forward indicating rupee could further depreciate against US dollar following overnight strength in greenback. Oil extended a rally, with Russia’s war in Ukraine nearing the one-month mark and no conclusion in sight. WTI crude rallied by 7% to $111 a barrel.

A gauge of the dollar’s strength rose after Fed Chair Jerome Powell said the central bank is prepared to raise interest rates by a half percentage-point at its May meeting, if needed to curb inflation. US Treasury 10-year yields rise 15 basis points to 2.3% and 2-year yield eclipses 2%. The gap between fiveyear and 30-year U.S. yields is the narrowest since 2007, signaling an economic slowdown as the Fed hikes borrowing costs.

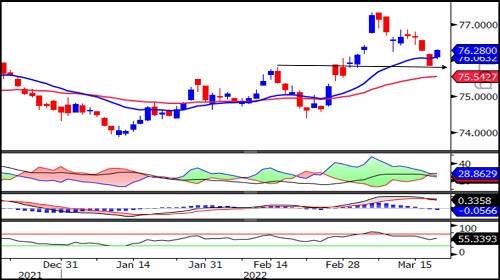

On Monday, spot USDINR gained 32 paise or 0.42% to 76.13. Technically, the pair has been in up trend with higher top higher bottom. It has support at 75.70 and resistance at 76.45.

RBI will ensure ample liquidity to support the recovery of its economy, Governor Shaktikanta Das said, signaling above-target inflation is not as much of a threat to economy. Although headline inflation breached the central bank’s 6% upper tolerance limit in the first two months of this year, the RBI has maintained that the price-growth was supply driven and transitory

Euro witness selling even after European Central Bank President Christine Lagarde on Monday played down fears about euro-area stagflation, despite Russia’s invasion of Ukraine starting to weigh on the economy.

USDINR

Technical Observations:

USDINR March futures manages to reclaim 21 days exponential moving average. It took the support at previous top and recovered.

Relative Strength Index of 14 days period reversed from 50 level and currently placed at 55

Derivative price actions indicated short covering as price rises and open interest declined.

MACD has given negative cross over but remained above zero line

ADX line placed above 25 and +DI stayed above –DI indicating continuation bullish trend

USDINR March futures bias remains bullish as long as it holds 75.70 while on higher side resistance placed at 76.80.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory