Rupee future maturing on August 26 appreciated by 0.13% on Wednesday amid persistent foreign fund inflows - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

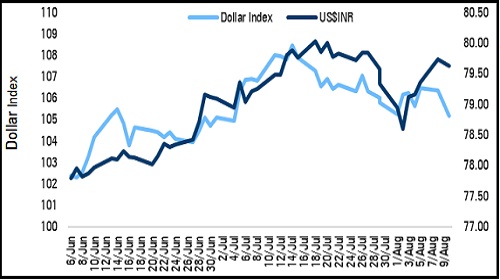

• The US dollar edged down almost 1.10% on Wednesday amid cooler than expected US inflation data for July, that raised expectations of a less aggressive interest rate hike cycle than previously anticipated from the Federal Reserve. The annual inflation rate in the US slowed more than expected to 8.5% in July of 2022 from an over 40-year high of 9.1% hit in June and below market forecasts of 8.7%

• Rupee future maturing on August 26 appreciated by 0.13% on Wednesday amid persistent foreign fund inflows

• The rupee is expected to appreciate today amid weakness in the US dollar and optimistic domestic market sentiments. Further, investors will remain vigilant ahead of initial jobless claims data from the US, which is expected to rise from 260,000 to 263,000. US$INR (August) is likely to trade in a range of 79.45-79.65

Dollar Index vs US$INR

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">